Reflecting on a record-breaking 2016 29 Dec 2016

Another year comes to an end, but the thirst for the underground infrastructure and construction shows no signs of slowing. The year 2016 marks the completion of some of the largest projects in the world, with the pipeline of work yet to be completed remaining as full as ever.

Herrenknecht TBMs conquer the Alps

None come larger than the Gotthard Baseline, the world’s deepest and longest rail tunnel currently, at 57km long. The project enjoyed its official opening in June – ahead of going into full commercial service in 2017 – thus bringing to an end 17 years of construction. Public interest in underground mega-projects is evidenced by the 160,000 applications received to be among the first 1,000 people to make the historic, world record-breaking, trans-Alpine crossing in Switzerland.

Like all tunnelling records, however, it will not last long – in this case barely a decade. In September, long-awaited contract award of the critical €993 million Mules 2-3 Lot of the Brenner Baseline Tunnel to the Astaldi/ Ghella/ Oberosler/ Cogeis/ PAC joint venture was confirmed. The main works package involves completion of the exploratory tunnel (14.7km) and the two main line tunnels for a total of 23km to be excavated using traditional methods, and a further 46km of TBM excavation. Construction is scheduled to take seven years, with the two remaining main tunnelling lots expected to enter the bid stage next year (2017). Once completed (in 2026), the trans-Alpine Brenner Baseline rail crossing between Italy and Austria will be 64km from end to end, and comprise a total of 230km of tunnels and adits.

Major project completions

Reflecting on Doha achievement

- Gotthard Baseline opening celebrations (June 2016)

- Doha Metro final breakthrough (September 2016)

- Final breakthrough for Seattle Northgate LRT (September 2016)

- Seattle University Link opens for service (March 2016)

- Western tunnels completed on Toronto Crosstown (May 2016)

- Final TBM breakthrough for Toronto Crosstown LRT (August 2016)

From world-record mountain crossings, to world-record sea crossings, with Europe once again taking centre stage. European construction firms including Vinci (France), Per Aarsleff (Denmark), Wayss & Freitag (Germany), Solétance-Bachy International (France), BAM (Netherlands), Boskalis International (Netherlands), Hochtief (Germany), Ed. Züblin (Germany) and Van Oord Dredging and Marine Contractors (Netherlands) swept the board for the €4 billion of major civil and underground packages of the Fehmarnbelt Link between Germany and Denmark – with the major design consultancy contracts awarded to COWI and SWECO (both of Denmark). Procurement delays had put the project up to two years behind schedule, and “significant” savings had to be identified before the contracts could finally be awarded, but once the mega combined road and rail crossing is completed in 2026 it will be the world’s longest immersed tunnel, featuring an unprecedented 89 precast concrete elements.

Meanwhile, milestone drill+blast breakthroughs were achieved in the second half of 2016 on what will be, once completed, the world’s longest subsea road tunnel at 22.9km. The interconnected tunnels of the Ryfast network will link the port city of Stavanger in Norway, across the fjord to Tau. Once again, however, the record will not last long. Project owner Statens Vegvesen, the Norwegian Highways Authority, is embarking on a large number of tunnel projects aimed at improving connectivity in the country and in November it announced that launch of prequalification for the first of three main tunnel contracts of the 26.7km Rogfast Project can be expected in the first quarter of 2017.

Norway’s historic association with the underground – fuelled in part by the challenges of its natural geography – continues unabated; and now, after an absence of 30 years, TBMs are playing a major role. Completion at the end of last year (December 2015) of an Arctic drive at Røssåga using a refurbished Robbins machine has been followed up this year with the launch of the first of four Herrenknecht TBMs for excavation of the high speed Oslo-Ski Follo Line; and the continued progress of the largest of the TBMs currently at work in the country – a 9.33m diameter Herrenknecht hard rock gripper machine currently excavating the 7.8km-long New Ulriken rail tunnel. With the volume of tunnelling activity currently under way in Norway, and against the backdrop of the newfound confidence in mechanised tunnelling, it seems appropriate that Bergen will host next year’s flagship World Tunnelling Congress event to follow this year’s successful event in San Francisco.

Ongoing projects

TBM Bertha undergoing maintenance in compressed air environment

- Brenner Baseline contract award confirmed (Sep 2016)

- Fehmarn Link mega-project awards (March 2016)

- Ryfast mega-project breakthroughs (October 2016)

- Norway prequalification of Rogfast contracts (November 2016)

- TBM tunnelling begins on Norway’s Follo Line (September 2016)

- Hard rock challenge for Norway’s largest TBM

- Half way milestone for TBM Bertha (October 2016)

Another mega-project to witness an end to TBM tunnelling during 2016 is Phase I of the Doha Metro in Qatar, with the last of 21 Herrenknecht EPBMs procured by project owner QRail breaking through at Hamad International Airport to mark completion of 111km of mechanised tunnelling, split across four construction contracts, and all in a world-record breaking 26 months since launch of the first machine in July 2014. In what has proved to be yet another year of record-breaking achievement, construction of the Doha Metro also set a new record for the number of TBMs working simultaneously on the same project (21). Work on the 37 stations, M&E and track installation will continue into 2017 and beyond, ahead of a planned opening in 2020 in time for the country’s hosting of the Soccer World Cup of 2022.

Other projects to complete tunnelling during 2016 include the much-delayed Bangalore Metro, where difficult ground and TBM breakdown meant final breakthrough on the north-south line was achieved more than two years later than scheduled. In the end, and unusually, a field service team provided by Robbins assisted contractor Transtonnelstroy/ Coastal in driving a pair of Herrenknecht EPBMs into Majestic Station from the south. Selection of EPBMs for the difficult ground of the north-south alignment was in contrast to the selection of Hitachi Zosen slurry TBMs for the similar ground conditions of the east-west line, which completed on schedule two years earlier – and was the subject of a TunnelTECH paper in January on TBM selection by Robert Moncrieff (see TunnelTECH research papers box below).

Elsewhere, continued progress on Seattle’s ambitious Sound Transit program was achieved in the form of final TBM breakthrough on the city’s Northgate Link – although problems with a refurbished Robbins machine on the penultimate leg of its scheduled drives forced the contractor JV of Jay Dee/ Collucio/ Michels to use a Hitachi-Zosen EPBM to complete the final drive into University of Washington Station. Earlier in the year (March) the all-underground University Link section as far as University of Washington Station opened for service, and by 2021 an uninterrupted service will run from downtown as far as Northgate. A public ballot on where best to spend money to develop the third phase of the city’s transit plan will be held next year (2017), and once again there is likely to be some underground construction required.

Meanwhile, the city’s other major project – excavation of the 17.48m diameter, double-decked Alaskan Way Viaduct Replacement Tunnel – enjoyed as spectacular a 2016 as it did 2015, but this time for all the right reasons. After a year of zero forward progress in 2015 following failure of the Hitachi Zosen TBM’s bearing seals, and the need to excavate a recovery shaft for removal and replacement of the cutterhead and drive unit, 2016 witnessed steady progress for contractor Dragados/ Tutor Perini towards more than 50% completion of the 2.7km alignment.

Project procurement

- Perth Forrestfield Airport Link award (February 2016)

- First contract award for Melbourne Metro (June 2016)

- Three teams shortlisted for Melbourne Metro tunnels (August 2016)

- Sydney Harbour Crossing bidders selected (September 2016)

- Shortlist for Melbourne highway mega-project (June 2016)

- Extreme challenge for Rondout bypass TBM (April 2016)

- Thimble Shoals tunnel contract award (August 2016)

- UK Potash mega project design changes (August 2016)

- Nine teams shortlisted for UK HS2 major civils (March 2016)

- East Coast Line contract rollout in Singapore (June 2016)

- KVMRT to repeat Line 1 success for Line 2

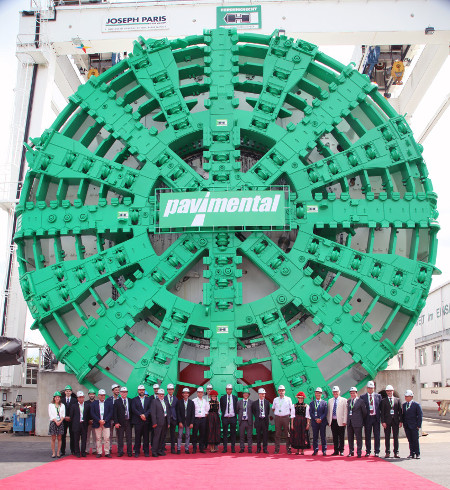

- Mega-EPBM for Italian highway tunnel (September 2016)

- Construction and construction management RFQ call for Los Angeles County Effluent Outfall Tunnel Project (December 2016)

In Canada, May saw the finalisation of TBM tunnelling on the 6.4km of western twin running tunnels of the Toronto Crosstown project by the Obayashi Canada/ Kenny/ Kenaidan/ Technicore JV on behalf of the regional transportation agency, Metrolinx; with final breakthrough by the Dragados/ Aecon JV on the 3.3km-long twin running eastern tunnels achieved in October. The project made use of four 6.5m diameter Caterpillar TBMs, among the last to come out of the former Lovat factory in Toronto prior to the American heavy equipment manufacturer’s decision in 2014 to sell all its TBM manufacturing and factory assets to the China-based Lovsuns/Liaoning Censcience Industry Co. Ltd (LNSS). Coincidentally, one of the very first Lovsuns/ LNSS TBMs to come out of the new Canadian/Chinese company’s Chinese manufacturing facilities achieved final breakthrough on the Ayvali-2 bypass tunnel in Zeytinburnu, Turkey, just a month later, in November.

Project procurement and new projects

In Australia, 2017 promises to be a busy year for the underground construction industry with a number of mega-projects either awarded, at bid stage or in the latter phases of procurement. The contract for 8km x 6.2m i.d. tunnels of the long-awaited Forrestfield Airport Link in Perth, Western Australia, was awarded to the Salini-Impregilo/NRW JV in February; John Holland won the deep shafts contract for the 9km Melbourne Metro with three international JV teams being shortlisted for the contract to deliver the main running tunnels; while in Sydney the Ferrovial/Acciona/BAM JV and the John Holland/CPB/Ghella JV will bid for the mega-contract to excavate 15km of twin running tunnels between Chatswood and Sydenham, via the city’s CBD, and under the Harbour, as part of the Sydney Metro City and Southwest program. Excavation will be by a mix of roadheader and an expected five TBMs, which will make this the largest underground project in Australian history in terms of the number of TBMs required.

Also in Melbourne, three joint venture teams were shortlisted in June for construction of the Western Distributor highway link that will feature either a short tunnel or long tunnel option, with contract award and construction start expected next year (2017).

In the USA, the Kiewit/ Shea JV is set to begin mechanised excavation in 2017 of the critical Rondout Bypass tunnel. Design and manufacture of the TBM is ongoing in Ohio following selection in April of Robbins for the supply contract; while Dragados USA in joint venture with its US subsidiary Schiavone Construction Company LLC is awarded a contract to construct the new parallel tunnel under the Thimble Shoal Channel of the Chesapeake Bay bridge and tunnel crossing after submitting the lowest of three rescoped bids at US$756 million.

Conferences

International gathering in San Francisco

Norway talks TBMs in countdown to WTC2017 (June 2016) Focusing on fire safety in Switzerland (June 2016) International bauma trade fairs (November 2016) bauma China report: The rise of Chinese manufacturers (December 2016) bauma CONEXPO India report: India, a reluctant powerhouse(December 2016)

In the UK, private funding is now complete for what will be England’s longest tunnel, the 37km mineral transportation tunnel of the York Potash project, for which the Hochtief/ Murphy joint venture team is selected for excavation of the 5.5m diameter segmentally lined tunnel. Meanwhile bidding teams were announced in March for the country’s largest infrastructure project, Phase I of the High Speed 2 rail project which includes more than 70km of TBM-bored running tunnels. Work continued throughout 2016 to move the north-south Crossrail 2 project into design, while also in London, NFM won the TBM supply contract from contractor Laing O’Rourke/ Ferrovial Agroman for two EPBMs that will excavate the long overdue Northern Line Extension.

In Singapore, award of underground contracts for the latest in a long list of that country’s underground transit projects, the 13km all-underground Thomson-East Coast Line, continued at full pace; while in Kuala Lumpur the 13.5km underground section of the city’s Metro Line 2 was awarded to the same MMC GAMUDA KVMRT JV that successfully completed the karstic challenge of delivering the underground section of Line 1.

And in a year in which records tumbled, mention must be made of Herrenknecht’s completion of the manufacture of Europe’s largest ever TBM (and the world’s third largest), – a 15.87m diameter EPBM for excavation of the 7,528m Santa Lucia Tunnel in the Apennine mountain range, Italy, located between Barbarino and Firenze Nord. The mega-machine dwarfs by 25cm the one manufactured by the same company for excavation of the parallel twin tube Sparvo highway tunnels, also in Italy.

Company News

Tom Melbye, (second from left), announced he would be standing down as Normet President and CEO after eight years in the post

- China deal for Robbins (June 2016)

- Lovsuns TBM breaks through in Istanbul

- Developing a new solution for tunnel transports

- Design collaboration for extreme-articulation TBM (October 2016)

- Doka acquires Dutch concrete specialist BAS (September 2016)

- Stantec acquires MWH for US$793 million (April 2016)

- Jacobs signs three-year deal with BASF (January 2016)

- Normet acquires Meyco dry spray concrete line (January 2016)

- Melbye stands down as Normet President and CEO (January 2016)

- Key management and operational changes at Normet (December 2016)

Company News and Industry Highlights

Once again, China continued to build its stake in the TBM manufacturing market. A process that started in 2002 with the acquisition by Northern Heavy Industries (NHI) of French manufacturer NFM, continued in 2013 with the acquisition of the intellectual property of Aker Wirth by China Railway Tunnelling Equipment (CRTE/CREG). 2014 saw the sale of all the TBM assets of Caterpillar/ Lovat to its one-time Chinese collaboration partner Lovsuns/ Liaoning Censcience Industry Co Ltd (LNSS). In June 2016 it was major American TBM player Robbins that moved under Chinese control as part of a deal that will see major investment by NHI in return for a 61% stake in the company, although the company retains its US presence in Ohio and claims it will be “business as usual”.

Other strategic partnerships in 2016 saw Mühlhäuser announcing it had penned a deal with SMT Scharf GmbH over the exclusive sale of a jointly-developed logistics solution for transports along the tunnel ceiling; TBM manufacturer Terratec, which continued to win major supply orders throughout 2016 in Thailand, India and Turkey, teamed up with Japanese manufacturer JTSC to design an extreme articulation EPBM capable of negotiating the tight-curve demands of the Phra Khanong Cable Tunnel Project in Bangkok, Thailand; Doka acquired Dutch concrete specialist BAS; Canadian based engineering design and professional services company Stantec acquired USA-based rival practice MWH Global in a deal worth US$793 million; Jacobs signed a three-year EPCM deal to provide technical and engineering support services to the large number of projects supported by industrial chemicals/ concrete solutions specialist BASF; while underground construction equipment and sprayed concrete chemicals manufacturer Normet strengthened its tunnelling offering through the acquisition of the Meyco dry spraying business from Atlas Copco, which itself had purchased Meyco from BASF in 2013. Just days after that deal was announced, one of underground construction’s long-serving pioneers, Tom Melbye, announced he would be standing down as President and CEO of Normet.

TunnelTECH: Research papers

Logistic management of segment production (October 2016) Modern seals for segment lining integrity (May 2016) Slurry or EPB for tough Bangalore conditions (January 2016) Semi-automatic tubular steel arch support (January 2016) Disaggregation of soil during slurry pipejacking (August 2016) SFRC durability in a chlorinated environment (April 2016)Throughout the year TunnelTalk continued to report on technological developments within the industry, attending many of the international conferences on offer throughout the year – including the industry’s principle gathering for 2016 at the World Tunnelling Conference in San Francisco, USA, in May – and publishing the best research papers across a spectrum of industry-specific topicsand authored by some of the world’s foremost experts in their fields. TunnelTalk continues to offer major project coverage, and, uniquely, we continue to operate an in-house video production unit to bring our many readers and advertisers the very best in digital online coverage.

-

TunnelCast video content

Follo Line TBM acceptance

Factory acceptance of Follo Line TBM (June 2016) Highway construction behind TBM Bertha (November 2016) Seattle TBM hyperbaric maintenance work (July 2016) Multi-profile TBM designs from China (July 2016) Innovative rectangular box-jacking TBM (July 2016) Concerns grow over underground risk (April 2016) -

Awards and accolades

Winners of the 2016 series of ITA Awards (November 2016) BTS hosts James Clark Medal recipients (December 2016) Fugro GeoServices awarded gold medal (December 2016) Canada honours underground achievement (October 2016) Knighthood for UK Crossrail chairman (June 2016)

To all of you a very happy holiday season, with all our best wishes for what promises to be as busy a 2017 as it was 2016. We look forward to reconnecting with old friends and current clients at the many industry conferences scheduled for 2017 and to establishing new editorial and advertisement opportunity connections as the year progresses.

Signup to receive our free weekly Alert of new editorial and company news content each Thursday and enjoy full use of our extensive and open-access Archive of industry specific data and record.

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.