DISCUSSION FORUM

Financing the Thames Tideway supersewer

17 June 2014

Peter Kenyon, TunnelTalk

- As the UK Secretary of State prepares to deliver his decision on whether to grant permission for the construction of London’s £4.2 billion Thames Tideway Project, current owner Thames Water has begun preparations to transfer ownership and construction of the 25km-long tunnel to the private investment sector. TunnelTalk News Editor Peter Kenyon looks at the issues involved.

- With the Thames Tideway Tunnel likely to be granted planning permission in the Autumn, project owner Thames Water begins the process of finding an investment consortium prepared to take on the enormous construction risk of building a 25km TBM-bored tunnel to significantly reduce CSO overflows into London’s iconic River Thames.

-

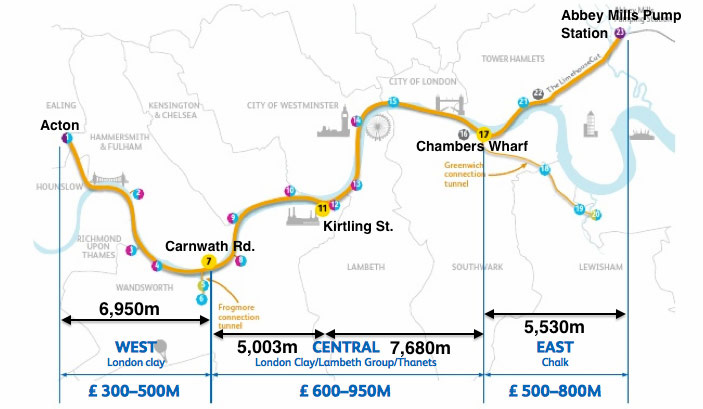

Thames Tideway tunnel construction lots

- According to the UK Government National Audit Office, Thames Water - as project leader and developer of the UK’s largest ever water infrastructure project - will have spent some £840 million of its customers’ money getting the project through the main design, planning, land purchase and procurement phases. That figure represents almost 20% of the total estimated 2011 project cost of £4.2 billion.

- The long-running project is nearing likely planning approval, and with tunnel construction scheduled to begin in 2016, Thames Water has selected bidders to compete for the three main tunnel contracts, due to be awarded in the second quarter of 2015. Bids for three construction packages are expected to come in somewhere between the £1.4 billion and £2.3 billion mark in total. This is a huge spread and one which, at this relatively late stage of planning, is a significant project risk in itself, and one which has made it impossible for Thames Water to calculate exactly how much funding is needed to take the project through the construction phase.

- This task will now be subject to bids from private finance consortia, a process that Thames Water, the UK water regulator Ofwat, and the UK Government, hopes will ensure better value for money for the water supplier’s 10 million customers than by financing the project as a public sector scheme. Final planning approval is subject to possible late design amendments that could include additional costly changes to TBM alignments and main shaft locations. In spite of the uncertainties that remain over final costs, however, Thames Water is seeking bidders to act as an ‘investment provider’ (IP) for the project, and move it to completion.

- Initially eight joint venture partnerships were shortlisted for the three main construction contracts, but for reasons that Thames Water refused to discuss with TunnelTalk, the Bechtel/Strabag JV has not made it to the bidding stage for the East Tunnel. It also refused to say what effect the recent announcement by German construction company Bilfinger that it is to withdraw from civil tunnelling would have on the tendering process. The company, in JV with Skanska and Razel-Bec, had been invited to submit a bid for construction of the most expensive single tunnelling lot: the £600-900 million Central Tunnel contract. That potentially leaves six joint venture teams competing for three construction contracts worth up to £2.4 billion in total. A Bilfinger spokesman told TunnelTalk: “We will not comment on specific projects but the sale has no effect on operational business.” Bilfinger has already stated its intention to transfer all its existing tunnel construction projects to the new owner as part of the sale. Significant interest in the purchase – expected to take a year to complete - is said to have been received from rival European firms including Skanska (its JV partner for the Central Tunnel), and Porr of Austria. It remains uncertain, however, what the status of the bid would be once ownership is transferred to any new buyer.

-

Table 1. Bidders for East, Central, and West tunnels Package/Lot Tenderers Cost range Contract type C405 West Tunnel Bam Nuttall/Balfour Beatty/Morgan Sindall JV £300-500 million NEC Option C Costain/Vinci/Bachy Solentache JV Dragados/Samsung JV Ferrovial Agroman UK/Laing O’Rourke C410 Central Tunnel Bam Nuttall/Balfour Beatty/Morgan Sindall JV £600-950 million NEC Option C Costain/Vinci/Bachy Solentache JV Ferrovial Agroman UK/Laing O’Rourke Skanska/Bilfinger*/Razel Bec JV C415 East Tunnel** Bam Nuttall/Balfour Beatty/Morgan Sindall JV £500-800 million NEC Option C Buoygues Travaux Publics Costain/Vinci/Bachy Solentache JV Hochtief/J. Murphy & Sons JV -

* Bilfinger announced withdrawal from all civil tunnelling in May 2014.

** Bechtel/Strabag JV was shortlisted to tender but is not making a bid.

- These latest developments post-date Thames Water’s decision in January (2014) to begin actively testing the financial markets for the necessary capital to construct the tunnel. This was carried out through issuance of an Expression of Interest Notice, or what Thames Water called a “market consultation exercise”. After receiving “significant interest” from potential investment consortia, thought to include sovereign wealth and pension investment funds from China and the Far East, Thames Water now announces officially that competitive bids are being called to fund £1 billion towards setting up a new utility company. This company’s function will be to continue with already well-advanced design of the Thames Tunnel and its associated infrastructure, and then build, finance, operate and maintain it as owner. The new company will be issued a licence by the UK’s water regulator, Ofwat, to operate as a utility company.

- Exactly how the financing model will operate in practice, however, is difficult to say. Asked a series of questions by TunnelTalk, Thames Water said it was unable to comment on the “commercial terms of the project”, adding that it was for “each bidder [to] develop their own finance plan”. The company refused to say how much investment was actually being sought, and also declined to reveal how much had already been spent developing the project to the stage that it is at now.

- What is known is that Thames Water is looking for “a single financial close” so that the selected Investment Provider will be in a position to award, and then manage, the tunnel construction contracts that are currently out to tender. This effectively means having an Investment Provider in place before April 2015. A spokeswoman told TunnelTalk: “The Investment Provider will award the construction contracts. We have already commenced a transition plan, having established Thames Tideway Tunnel Limited, of which Sir Neville Simms is the Chair and Andy Mitchell [the former Chairman of Crossrail before moving to his new post earlier in the year] is CEO. This company will be staffed to provide the necessary capability in order to deliver the project.”

- It is also known that the Investment Provider will benefit from the transfer of a full project management team that until now has been responsible to Thames Water. It will also take over the project management agreement with CH2M Hill, which has been leading the design of the tunnel up to now. Having all these arrangements in place makes the “investment opportunity”, as Thames Water calls it, significantly more attractive.

- Despite vagueness over the financial details, clues to the way the arrangement will work are evident in the Expression of Interest Notice that was issued to the banking and investment services market earlier this year.

- Bidders will be invited to submit their own weighted average cost of providing capital (WACC) during the construction phase, rather than have this fixed by the UK water regulator. Once construction is completed responsibility for setting this figure will pass to the regulator. The Investment Provider will also be entitled to a running yield throughout its life, and, to make the investment more attractive during the anticipated seven-year construction phase, dividends will be paid by Thames Water customers in the form of rate increases to their water bills. This will be in addition to rate increases that have already been approved to fund the project through the design and planning stages.

- The Expression of Interest Notice states that “payment of dividends would be subject to the financing structure and performance and success in delivery of the project”. Additionally, the Investment Provider will be shielded from the effects of any sudden inflationary cost of running debt during the construction period – again, likely to be in the form of increased revenue payments funded by Thames Water customers. “There would be revenue adjustment for real cost of debt to limit the infrastructure provider’s exposure to market cost of debt during the construction period.”

-

£2.4 billion Thames tunnel will reduce CSOs into River Thames

- Bidders will be required to fund capital costs of construction and delivery of the project up to a “pre-specified maximum threshold amount” – but currently it is not clear what this figure will be. According the Expression of Interest Notice: “Construction cost overruns would be shared with contractors pursuant to the target cost mechanisms in modified NEC3 contracts. Investors would be required to fund costs up to a pre-specified maximum threshold amount (Threshold Outturn) and overall cost overruns would be shared with customers (up to the Threshold Outturn) through [various] regulatory mechanisms”. Above this threshold amount there will be minimal risk to the Infrastructure Provider, with the UK Government taking on this extra risk in the form of a pledge to make funds available via a support package. The Government will also step in to provide “contingent financial support to the infrastructure provider for exceptional project risks where this offers better value for money for customers and taxpayers". This support would be in the form of a government support package during the construction phase, and effectively guarantees a lender of last resort in circumstances where exceptional project risks during the construction phase make the cost of raising the necessary capital to complete it prohibitive.

- Hannah Shroot of Thames Water told TunnelTalk that this latter level of government support is primarily aimed at addressing the commercial cost of providing exceptional insurance cover during construction. A spokeswoman explained that “the Government has agreed, in principle, to provide contingent financial support for exceptional project risks where this offers the best value for money for customers and taxpayers. This relates to exceptional and remote risks associated with the Thames Tideway Tunnel, such as cover above commercial insurance limits”.

- So, who is likely to be interested in bidding to be an Infrastructure Partner? Thames Water says it is “pleased with the level of potential interest in this opportunity shown by the market”, and it seems that the terms offered will be attractive to pension and sovereign wealth funds - particularly those in China - looking for a steady rate of return. Thames Water itself was acquired in 2006 by Kemble Water Holdings, the investors in which are pension funds and long-term institutional investors as well as pension funds and institutions from the UK and Europe, Canada, Australia, the Middle East and China. In the last few years the UK Government has been actively seeking Chinese investment in UK infrastructure mega-projects – notably the £36 billion HS2 rail scheme – and in January 2012 the Chinese sovereign wealth fund, the China Investment Corporation, acquired a 9% stake in Thames Water’s owner, Kemble. The Abu Dhabi Investment Authority also recently acquired a 10% stake in Kemble, further demonstration of interest by sovereign wealth funds in investing in UK infrastructure.

-

Live tests for ‘smart segmental linings’ - TunnelTalk, April 2014

Simms and Mitchell to oversee Thames Tunnel private financing - TunnelTalk Career Moves, January 2014

Bidders line up to deliver Thames Tideway mega-project - TunnelTalk, October 2013

Super sewer to revitalize River Thames - TunnelTalk, March 2009

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.