HS2 will run late and well over budget 05 Sep 2019

Phase 1 of HS2 is likely to be delivered up to five years later than estimated and up to £11 billion over budget, according to HS2 Ltd Chairman, Allan Cook. In a report to the UK Minister of Transport, he also recommended considering third-party funding to help cover the rising costs of the project, especially for later parts taking the route to Manchester and Leeds, while adding that project oversight and management should be reviewed to ensure they are fit for purpose.

Cook confirmed that the cost is “likely to rise from £27 billion to a range of £36 billion to £38 billion”, while recommending the “target delivery date of December 2026 should become a more realistic, manageable and cost-effective staged opening between 2028 and 2031”.

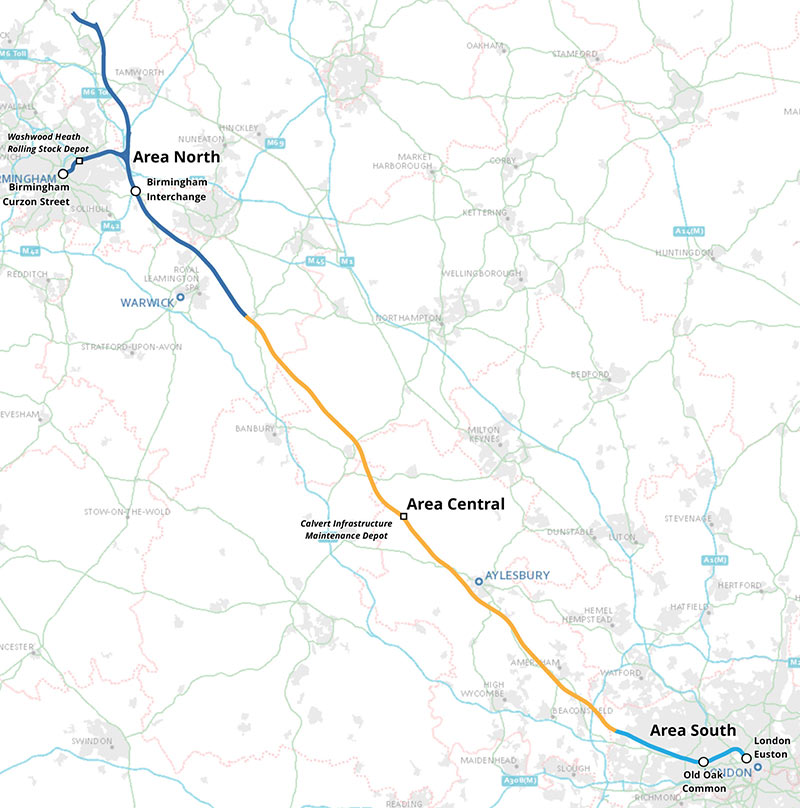

Phase 1 runs from London to Birmingham. Under Cook’s advice, initial services would run between London Old Oak Common Station and Birmingham Curzon Street Station with services through to London Euston Station following later. Phase 2a, running between Birmingham and Crewe, should be combined with Phase 1 and delivered to the same timescale. Cook expects costs for Phase 2a to be between £3.6 billion and £4.0 billion.

It is the Phase 2b high-speed link between Crewe and Manchester and Birmingham and Leeds that faces the greatest potential changes. “There is an opportunity to fully integrate the plans for each region and deliver them in smaller, more manageable sections as part of a rolling programme of investment in the Midlands and the North,” said Cook. The cost of Phase 2b is likely to rise from 28.6 billion to a range of £32 billion to £36 billion with a target delivery moving from 2033 to between 2035 and 2040.

Revising costs to 2019 prices, this report brings the estimated cost of HS2 to between £81 and £88 billion.

The Cook report is separate to an independent review of HS2 currently underway under the chairmanship of Doug Oakervee. This review is due to report later this year and is considering affordability, deliverability, benefits, scope and phasing. In addition to the Cook report and independent review, the UK National Audit Office is also pursuing an audit of the project, the costs and schedule pressures and the steps taken in response. “I want to be clear that there is no future for a project like this without being transparent and open, so we will be candid when challenges emerge,” said Grant Shapps MP, Minister for Transport, in a written statement to Parliament.

“During the short period in which the independent review completes its work I have authorised HS2 Ltd to continue the current works,” continued Minister Shapps. “This will ensure we are ready to proceed without further delay for the main construction stage of Phase 1, if the Government chooses to continue. Similarly, I intend to progress the next stages of the Bill for Phase 2a [Birmingham to Crewe] in the House of Lords while the review is ongoing.”

References

- UK Government announces HS2 review – TunnelTalk, August 2019

- UK public infrastructure projects hang in the balance – TunnelTalk, July 2019

- Political upheaval and Brexit – TunnelTalk, March 2019

- Volatility forecasts an unpredictable 2019 – TunnelTalk, January 2019

UK Government announces HS2 review 22 Aug 2019

The future of HS2 hangs in the balance after UK Prime Minister Boris Johnson announced a review of high-speed rail project, HS2, to decide whether and how to proceed. The review will be completed before the Notice to Proceed decision for Phase 1, the link between London and the West Midlands, which was due by the end of 2019. The review comes after it was announced the project would cost significantly more than originally expected, at about £86 billion.

“The Prime Minister has been clear that transport infrastructure has the potential to drive economic growth, redistribute opportunity, and support towns and cities across the UK, but that investments must be subject to continuous assessment of their costs and benefits,” said Secretary of State for Transport, Grant Shapps. “That is why we are undertaking this independent and rigorous review of HS2.”

Among the items to be examined are whether HS2 Ltd is in a position to deliver the project effectively, taking into account its performance to date, as well as the benefits of the project and its costs. The review will also ask whether the assumptions made by the project business case, such as passenger numbers and train frequencies, were realistic, as well as considering the location and interconnectivity of the proposed stations with other transport systems and the implications of potential changes in services to cities and towns that are on the existing main lines but will not be on HS2.

Critically, the review has also been asked to consider the realistic potential for cost reduction, including possible reductions in speed along the route, the building of only Phase 1, and combining Phases 1 with parts of Phase 2, as well as the direct cost of cancelling or de-scoping the project. This latter item will examine contractual penalties, the risk of legal action, remediation costs, impact on the supply chain, and an estimate of how much of the money already spent, for instance on the purchase of land and property, could be recouped.

The review will be chaired by Doug Oakervee, the former Chairman of HS2 Ltd. Lord Berkeley, a long-term critic of HS2 and former Chairman of the Rail Freight Group, the industry representative body for the rail freight sector, will be Deputy Chair. Also sitting on the review panel will be:

- Michele Dix, Managing Director of of Crossrail 2

- Stephen Glaister, Professor of Transport and Infrastructure at Imperial College, London.

- Patrick Harley, Leader of Dudley Council

- Sir Peter Hendy, Chairman of Network Rail

- Andrew Sentance, an economist and former Member of the Bank of England Monetary Policy Committee

- Andy Street, Mayor of the West Midlands

- John Cridland, Chairman of Transport for the North

- Professor Tony Travers, Director of LSE London

According to the Government statement, each member of the panel will focus on a specific area of interest, feeding into the report’s conclusions, but without having a right of veto in the event that consensus cannot be reached. “Douglas Oakervee and his expert panel will consider all the evidence available, and provide the department with clear advice on the future of the project,” concluded Minister Shapps.

Limited preparatory work will continue on the project in parallel with the work of the review panel, HS2 Ltd said in a statement.

References

- UK public infrastructure projects hang in the balance – TunnelTalk, July 2019

- Political upheaval and Brexit – TunnelTalk, March 2019

- Volatility forecasts an unpredictable 2019 – TunnelTalk, January 2019

UK public infrastructure projects hang in the balance 25 Jul 2019

As Boris Johnson takes up residence in No 10 Downing Street as the new Prime Minister of the UK, the future of major public investment projects for the country hang in the balance. Not only is the prospect of a no-deal exit of Britain from the European Union (EU) a real threat for the country and its economy, so too is the falling value of the British currency, which has fallen by up to 15% against the Euro since the country voted to leave the EU in June 2016.

HS2, the high-speed rail link, is the highest profile public investment project that hangs in the balance under the new administration. Boris Johnson is a known skeptic of the flagship project to link the north and south of the country. The future of the project was not helped either by recent announcement from the project delivery organisation, HS2 Ltd, that raised doubts that the full Phase 1 and 2 scope of the project, to link London to Birmginham and on up to Edinburgh and Glagow, can be delivered for the estimated £56 billion, commenting that an additional £30 billion may be needed to complete the dedicated high speed railway (Fig 1). Estimated at £27.18 billion, in 2015 prices, Phase 1 between London and Birmingham is currently in development and is scheduled by HS2 to be operational by late 2026.

The one optimistic hope among those leading the project, is that its development has advanced too far for any political change of administration to bring it to a halt. In a recent interview with the BBC news channel, HS2 Ltd CEO Mark Thurston, who has led the project since March 2017, addressed the question head on. He said that more than 9,000 jobs depend directly on the project and that more than £5 billion has been spent on developing the project to date. “This is a long term strategic investment,” he said “with an estimated £56 billion to be invested over 25 years to build the full scope of the link north to Edinburgh and Glasgow and bring transformational change to transportation across the country and further on.”

He continued, saying that: “all major public investment projects divide opinion. The same was true of the Channel Tunnel” but like the Channel Tunnel, “future generations will thank us” for realising the project against hurdles thrown into its way. He did accept also that there is suggestion that the project be amended to terminate in London at Old Oak Common and drop the link into Euston Station as the London Terminus for services. Against this he defended the current project saying that the project needs to be city centre to city centre to bring the greatest benefit, part of which is to add transportation capacity to currently overstretched public transport services including the London Underground, and to help also achieve climate change goals by reducing carbon emissions. This will have been some comfort to the teams currently working on the Euston-Old Oak Common link and the redevelopment of Euston Station to increase capacity and accommodate the HS2 terminus, all of which is aligned underground and comprise one of the most expensive elements of the Phase 1 project.

Standing by to know more from the new Boris Johnson Government will be the designers working on the project and construction teams that have been engaged as preferred contractors through the detailed design and development stages before contracts are finalised for advancing into construction. Among these include the following appointments.

The partnership of design engineering firms CH2M, Atkins and SENER was engaged in March 2016 as Phase 1 Engineering Delivery Partner to be integrated fully within the HS2 Ltd organisation to manage the mega project.

In July 2017 the following construction teams were engaged as preferred delivery partners for the 240km long Phase 1 route sections:

Area South

- S1: Euston Tunnels and Approaches – Skanska/Costain/Strabag JV

- S2: Northolt Tunnels – Skanska/Costain/Strabag JV

Area Central

- C1: Chiltern Tunnels and Colne Valley Viaduct – Bouygues/VolkerFitzpatrick/Sir Robert McAlpine

- C2: North Portal Chiltern Tunnels to Brackley – Eiffage/Kier JV

- C3: Brackley to South Portal of Long Itchington Wood Green Tunnel – Eiffage/Kier JV

Area North

- N1: Long Itchington Wood Green Tunnel to Delta Junction and Birmingham Spur – Balfour Beatty/Vinci JV

- N2: Delta Junction to WCML Tie-In – Balfour Beatty/Vinci JV

Excavation of the 39km of twin running tunnels are included under Phase I of the project. For the longest underground section of the route the Skanska/Costain/Strabag JV is expected to procure two 8.25m–8.45m diameter TBMs to excavate the 7km long Euston to Old Oak Common tunnels and a further four TBMs of 9.5m–9.7m diameter for excavation of the 14km long Northolt Tunnels.

The Eiffage/Kier JV will require two TBMs of 9.5m–9.7m diameter for excavation of the third major tunnel through the Chiltern Hills at 13.4km long and additional machines for the 1.5km long Long Itchington Wood Tunnel and the 2.8km long tunnel on the approach to the new Birmingham International Station.

In early 2018, firms were appointed to design the main stations of the route.

- Arup for the London Euston Stations and the Birmingham Interchange Station

- WSP for the Old Oak Common Station in London and for the Birmingham Curzon Street Station

In February 2019, preferred contractors for the two London stations were announced.

- The JV of Mace of the UK and Dragados of Spain for the Euston terminus station works

- A consortium of Balfour Beatty, Vinci of France and French engineer Systra for the Old Oak Common Station development

At Euston station, and under a contract valued at £1.3 billion, the Mace/Dragados will more than double the existing station capacity, building 11 new platforms and large underground SCL works to create links to the London Underground lines that connect passengers to the intercity overground train services at the station. Under a contract of nearly £1 billion at Old Oak Common, the Balfour Beatty/Vinci JV, will build six 450m long platforms in a 1km long underground station box and an over-bridge to provide direct access to London’s new Crossrail Elizabeth Line.

Many other contractors, engineering firms, geotechnical companies and service providers are engaged both on early enabling works contracts and for developing the baselines and systems required to take the project through its civil construction phase and into the vital and often underestimated stage of installing electrical and mechanical operating systems and taking the system through the commissioning and testing phases.

As the industry watches the fate of HS2, and critically its Phase 1 programme, other major tunnelling projects in the UK are impacted by different concerns now controlled by the new UK Government. While the Woodsmith potash mine development in Yorkshire, the 32km of cable tunnels in London, and the Silvertown highway tunnel under the Thames in London, may not be relying on central government funding, they are nonetheless concerned particularly about the Brexit process. The projects have awarded major construction contracts to European companies or have European companies bidding for major contracts, the projects and their suppliers in UK will be concerned also about the falling value of the UK sterling currency and the affect it will have on the costs and processes of importing machinery, supplies and services from Euro based sources.

All of these worries add to the turbulent political and financial state in which the UK finds itself and this juncture in its long history.

References

- Project reaction and disruptions as 2018 phenomena – TunnelTalk, December 2018

- Volatility forecasts an unpredictable 2019 – TunnelTalk, January 2019

- Political upheaval and Brexit – TunnelTalk, March 2019

- 'Speed up delivery to cut costs' says HS2 former boss – TunnelTalk, March 2014

- More funding and first TBM ready for UK potash mine – TunnelTalk, January 2019

- New London cable tunnel in the bidding – TunnelTalk, July 2019

- Spanish group selected as Silvertown preferred bidder – TunnelTalk, May 2019

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.