Industry strong, but can it last?

Feb 2010

Paula Wallis, TunnelTalk

- Nothing brings a sense of optimism and vitality to communities more than large public infrastructure projects. They are tangible evidence that governments are spending to get people back to work in an effort to stabilize local and regional economies. But behind the grand promises of the stimulus programs in various regions of the world, there is growing uncertainty. Central government stimulus funding is yet to transfer into high value construction projects with high volume job opportunities and what happens when that source of funding dries up? Will local and regional governments have recovered sufficiently, and the global credit crunch eased enough, to create the next set of infrastructure projects? This overriding concern in an otherwise robust outlook for the tunneling sector has many in the industry cautiously optimistic for the industry over the next 24 months.

-

- If the world’s largest construction machinery trade fair is any barometer, business is booming. BAUMA 2010 in Germany in April will be the largest ever, with a record 555,000m2 of exhibition space completely booked. The tunneling industry will be well represented with many companies expanding their presence at the show and others exhibiting for the first time with a few notables absent including Mühlhäuser, Sika, and Schwing. At BAUMA 2007, 605 exhibitors from 31 countries promoted their products and technology for the global heavy construction industry. At BAUMA 2010 Brazil will be represented for the first time with a group stand, and there are two new group stands from the United States.

- "The increased demand for national pavilions, and also for individual exhibition space, particularly in the mining and tunneling section, shows how well established this section has now become at BAUMA, since its inclusion for the first time in 2004, just two events ago,” said Eugen Egetenmeir, a member of the management board of Messe München GmbH, one of the world's leading trade-fair companies. “Mining and tunnel construction are promising markets for the future of the industry worldwide."

- The major manufacturers of TBMs and tunneling equipment will be showcasing their newest developments that will contribute to increased safety and efficiency of tunnel construction, including Herrenknecht and its subsidiaries; Atlas Copco; Robbins; Lovat, now part of the giant exhibitor Caterpillar; and Wirth, now part of the giant Aker Solutions of Norway. Normet, a leading manufacturer of mining and underground equipment and vehicles, plans to unveil several new products and innovations at BAUMA as it continues its expansion to service a global market. “Considering the market conditions, 2009 was a good year for Normet. Expectations for this year are positive. The global tunnelling market is growing continuously and investments in capital equipment in the mining market are picking up as the price of raw material increases,” said Normet CEO Jari Osmala.

- The economic forecast for the tunneling industry several years out will come into sharper focus in May in Vancouver, Canada when the World Tunnelling Congress (WTC) will host the 36th Annual General Assembly of the 55 member nations of the International Tunnelling and Underground Space Association (ITA-IATES).

- Martin Knights, President of the International Tunneling Association (ITA) says there's no shortage of tunneling projects everywhere, but some regions of the world are fairing better than others. "Singapore, Hong Kong and Australia are booming with projects moving forward," said Knights. “China is busy as always but that’s just for the Chinese and a

-

Crossrail's underground route beneath London

- handful of privileged suppliers, however the ITA believes that China although growing its own infrastructure has its sights on exporting and partnering to a greater degree on overseas projects. The USA market will grow as well, as will the West European market, but pace will not be as expected." Knights is also bullish on the Gulf countries. "The Gulf has been dormant for a while, but l see that there will be great potential and appetite to build underground in Gulf countries, especially if oil prices remain at or above current levels. Going underground is affordable for these countries."

-

Crossrail in the UK is a big project to which government funding has been committed although a possible change of administration after a general election before June could put the breaks on parts of the project or its schedule of development. And the huge Brenner Pass base line tunnel project between Austria and Italy, with high-speed rail links further across the continent is a program of work in the near future if funding can be secured and assured. According to Martin Herrenknecht, the United States, Russia, Australasia, the Middle East and South America will be the tunneling hot spots for the foreseeable future. India and China continue to invest heavily in metro and hydropower schemes and will continue to figure prominently for major suppliers. As of October last year, Herrenknecht had 160 TBMs working in China with much more planned. Sandvik opened its largest ever manufacturing and assembly plant to date in China last year. Even some East European countries are preparing for major tunnel activity. - TunnelTalk was told that the outlook for the tunneling industry in Poland for example is promising. Anna Lewandowska, President of the Polish Underground Construction Committee and professor at the Warsaw University of Technology, reported that; "We expect a greater number of tunnelling projects will be going into construction in 2010, 2011 and 2012 with increased investment by the European Union for infrastructure projects, and particularly as Poland and the Ukraine prepare for the European football championships in 2012."

- Among the projects is the 6.1km long second metro line in Warsaw with its seven underground stations designed at present as cut-and-cover structures. The contract for the €800 million project was awarded to a consortium led by Italian contractor Astaldi and including Turkish firm Gülermak and Polish contractor PBDiM. Construction is set to begin this spring with completion planned for 2013 or 2014. Poland is also planning its first underwater road tunnel. A twin tube TBM road tunnel under the Vistula estuary in Gdansk is part of the 8km long Sucharski Route to improve access to the port. Some 85% of the funds for these investments will come from the European Union.

-

US prospects

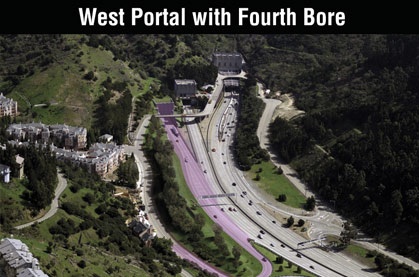

In the United States $170 billion of the Federal Government's 2009 American Recovery and Reinvestment Act (ARRA) has been earmarked for infrastructure projects to jump start local economies. Although small compared to the fund as a whole, the largest single allocation of stimulus funding in the US to date has gone to a tunneling project. Allocation of $197 million from the ARRA for the fourth bore of the Caldecott Tunnel in Northern California has fast-tracked the project into construction, marked last month with a ground breaking ceremony. Last month President Obama awarded an additional $8 billion to various high-speed rail projects across America as a down payment in creating world-class high-speed rail systems in high ridership corridors across the country.

-

Caldecott West portal with fourth bore in pink

- David Klug, Chair of the American Underground Construction Association said that the calendar year 2009 was very busy for most industry designers, contractors, subcontractors and suppliers as many major projects were bid all across North America. He believes the trend will continue over the next 24 months as the economy improves. "Based on current market indications, I see 2010 and 2011 to be stronger for sales than 2009. The ARRA has helped some major projects, but in general and aside from the Caldecott Tunnel project, it has not benefited the tunnel industry with regards to advancing actual construction. So far it has done more to assist the design, engineering sector of the business than the contractors, subcontractors and suppliers."

- Water and sewer projects have seen very little in the way of ARRA funding and in some especially hard hit areas, local governments looking into the fiscal abyss have been forced to cancel projecs. The first of two tunneling contracts on Detroit's $1.5 billion Upper Rouge River CSO project was already awarded, already 'shovel ready', but terminated and the entire project shelved due to the economic downturn in an area already depressed by earlier economic crashes and changes. Supporting the Upper Rouge River CSO south tunnel contract to the tune of $316 million as the total investment would not have made a great dent in the $170 billion ARRA fund.

- Governments everywhere are facing huge deficits and many in the industry fear stimulus funding will run out before the next set of projects move into construction. Tunneling activity has come to a screeching halt in Spain and Portugal that were booming with high speed rail and metro projects in the last decade. The EU zone is in financial straits. Greece has imploded and there's concern in the UK. “UK contractors do need to look at overseas partnerships to mitigate risk to UK programmes of work," said Knights.

- In America, many state and local governments are mired in deep fiscal crisis, particularly states that generate significant construction volume, like California and New York. At some point they are not going to be able to look to the Federal Government to close their budget gaps, and will be forced to look to their state taxpayers says Anirban Basu, Chief Economist for the American Associated Builders and Contractors. "They are not going to be raising taxes in 2010 because in many states this is an election year," said Basu. "However there's going to be a lot of budgetary cutting probably in 2011 as we enter a non-election year and as the ARRA monies run out."

- Sewer and water fees are also destined to go higher as the Environmental Protection Agency (EPA) forces many cities to upgrade their sewer systems. "It will be interesting to see how the EPA responds to the on-going financial weakness at the local government level and to see if it remains aggressive in requiring certain cities to engage in significant infrastructure spending during very lean fiscal times," said Basu.

-

Upper Rouge Tunnel contracts

- Certain sectors will fair better than others going forward. In developing countries hydroelectric systems will remain strong along with roads and highways. "Climate change means more storm relief projects around the world," says Knights, "and cities will continue to expand their metro systems as mass transit is the only viable option for urban transport."

- "In North America, rail should be good," said Bill Edgerton, a Principal with Jacobs Associates in the United States. "Projects funded primarily with state and local money will be hard pressed to go forward. The number of new water and sewer projects will be so-so. Roads will be weakest, because the needed state and local funding is scarce at the moment."

- The advice to contractors and suppliers looking to weather the next few years is to stay lean, says Klug. "The key to this market for contractors and suppliers will be to keep your product costs and overhead costs low, as the heavy construction market is being eyed by people from the commercial and industrial construction sector. Plus, smaller contractors are willing to take more risks and move up the food chain to take projects that a year ago would be deemed beyond their level of capabilities, and larger contractors move down the food chain if work is not available in their traditional markets."

- Mike Rispin of Normet North America says customer service is also paramount. "We really see a trend continuing towards an increase of either contractors or mines being reliant on their suppliers for service or expertise. You not only have to supply your core competency, in our case equipment, you've got to be able to supply people with process knowledge that can make sure that that equipment is being used as efficiently as possible by the customers."

- Despite the uncertainties there is reason to be positive. Owners and the public are becoming more convinced of the sustainability argument for underground construction and changes in equipment and materials are making tunnels less expensive when compared with alternative solutions. "The most positive aspect of the tunnel business is that we build what I call 'quality of life' projects and if they are properly presented by the project owners, the taxpayers and ratepayers will approve and support them ," said Klug. "If owners develop and announce construction programs with continuous funding they will attract skilled and competent companies. The New Jersey Access to the Regions Core Program is an excellent example of how to conceive, promote and execute a major tunnel program in an urban environment."

-

10 designated high speed rail corridors

- Looking forward many believe the mergers and acquisitions in recent years, such as Parsons Brinckerhoff being taken over by Balfour Beatty; Lovat by Caterpillar; Wirth by Aker Solutions; will continue as will the shortage of trained and proven tunnel engineers and managers in the owner, design engineer, contractor, sub-contractor and supplier sectors of the heavy construction industry. As the projects become more complex, companies will struggle to attract and maintain the talent to manage such work.

- "We need to recruit a professional work force that is also representative of society. We need more women in the industry, a better ethnic mix, and greater tolerance of older people staying on in industry for all sorts of reasons including mentoring in-coming talent," said Knights. "There needs to be more career training to update skills. The industry needs to fill gaps left by government education systems in training and growing the resources needed for industry. There are several significant initiatives in this area including a tunneling academy established with the support of the Crossrail project in London to help educate and train the manpower needed to realize that £16 billion investment. The ITA has also established a Foundation for Training to address this important need within the global industry." TunnelTalk will investigate the aging of the industry and what companies, universities and the industry as a whole are doing to attract and retain young engineers to underground construction.

- Knights and others also argue that more engineers need to move into politics and become more outspoken and articulate about the benefits of the underground and convey the pride in the essential work that engineers do - another topic that TunnelTalk plans to address in the coming months.

-

BAUMA Exhibitor previews - TunnelTalk, Feb 2010

Shortlist for Crossrail running tunnels contracts - TunnelTalk, Dec 2009

Brenner Baseline high-speed rail - TunnelTalk, Feb 2008

Caldcott Fourth Bore Groundbreaking - TunnelTalk, Feb 2010

President Obama kick starts US high-speed rail - TunnelTalk, Feb 2010

Upper Rouge CSO cancelled - TunnelTalk, June 2009

BAUMA 2010

ITA-AITES World Tunnelling Congress 2010

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.