Alliance procurement for value and risk management 06 Jul 2017

The success or failure of a project can often be traced back to decisions made prior to and during the procurement of the construction contractor when the potential consequences of these decisions are not well understood. Effective risk management decision-making is key to ensuring the selection of an appropriate procurement model while also ensuring that all relevant information is sourced and shared to ensure a common understanding of residual risks through the construction phase. There remains the danger also that commercial pressures can lead to decisions that elevate construction risk profiles. The commercial model and the alliance principles inherent in the alliance agreement adopted for procurement of the Waterview highway project, while not substitutes for effective risk management practices, are considered to be effective catalysts in ensuring project risks are managed in accordance with the ALARP (as low as reasonably practicable) principle.

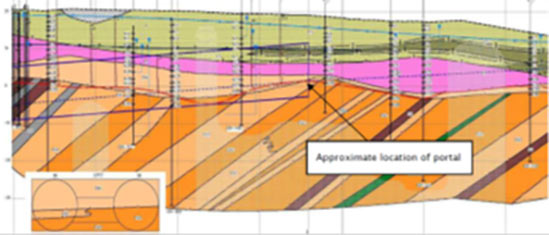

The 4.5km long highway connection project is designed to resolve a major motorway bottleneck in the city of Auckland in New Zealand and includes a subsurface length of 2.5km to pass under a built up residential area from the east and under a major local surface road before surfacing and connecting on the west to a full motorway-to-motorway interchange (Fig 1).

In preparing to advance the project, the New Zealand Transport Agency (NZTA) selected its premium alliancing contract model used for projects that are highly complex and have inherent risks that are best managed through a collaborative contracting relationship. While a number of tunnels have been built in New Zealand none were of the size or length required for the Waterview Connection. The length of the tunnels and their operating environment also required specialised fire and life safety features while construction would take place in an environmently sensitive built up residential area with major traffic issues.

Project alliancing was first used in the UK oil and gas industries in the early 1990s with an owner forming an alliance with one or more service providers (designer, contractor, suppliers etc) for the purpose of delivering outstanding results on a specific project. The method then became widely used in Australia.

There are key differentiators of alliances from other contracting models.

- Performance obligations are generally stated to be collective. The alliance participants commit to working together to achieve successful project delivery, to act in good faith and to work within an agreed set of alliance principles.

- Reimbursement to the non-owner participants is 100% open book, subject to verification by audit, and can be described as a three-limb compensation model :

- Limb 1: 100% of what they expend directly on the work including project-specific overheads.

- Limb 2: A fixed lump sum fee to cover corporate overheads and profit.

- Limb 3: An equitable sharing of gain/pain depending on how actual outcomes compare with pre-agreed targets in cost and non-cost performance areas.

- The project is governed by an alliance board with all party representatives carring full authority to bind the party and all board decisions are required to be unanimous.

- There is a commitment to resolve issues without recourse to litigation except in the case of willful default.

The decision to use the project alliance model for the Waterview Connection project can be summarised as follows:

- Risks could not be adequately defined or dimensioned prior to tendering - a common feature of tunnel projects.

- The cost of transferring risk would be prohibitive under an alternative design and construction model. Alliancing provides for risk sharing.

- A collective approach will produce a better outcome with the alliance allowing for the project to be refined progressively and developed to reflect emerging risk.

- A whole of life approach. Operating costs of tunnels are high and it was felt that combining the design and construction phase with a 10 year operate and maintain phase would allow optimal decision making across the two phases.

- Value for money. The commercial arrangements in the alliance model strongly incentivises parties to achieve value for money and also relies on the competitive process to drive innovation to achieve a lower initial target outturn cost (TOC), as demonstrated across a number of Alliance projects in Australia and New Zealand.

- The NZTA had acquired the skills and capacity to influence or participate in the development and delivery of the project. The model allows for the combination of skills from all parties to be applied to the collective outcome.

In developing the project, the procurement process was also refined to provide compliance with the Code of Practice for Risk Management of Tunnel Works (TCoP) prepared by the International Tunnel Insurance Group (ITIG, 2006). The principle of shared risk within an Alliance incentivises a common understanding of project risks prior to finalising the alliance agreement and therefore should enable superior risk management through construction and beyond. As best practice risk management is a primary objective of TCoP this procurement method should be beneficial to all concerned.

One of the main objectives of the TCoP is to set minimum standards for risk assessment and ongoing risk management procedures for tunnelling projects whereby compliance with the TCoP should minimize the risk of physical loss or damage and associated delays to a level ‘as low as reasonably practicable’ (ALARP). Significantly there are three sections addressing activities in the pre-design stages including: client role and responsibilities; project development stage; and contract procurement stage. This is an acknowledgement that risk management practices need to be instigated well in advance of commercial phases, so that commercial competition does not lead to a significant elevation of project risk. In particular the practice of gaining commercial advantage by taking on a potentially unmanageable level of risk is one of the outcomes to be avoided by the TCoP.

The Alliance concept is considered to maximise the potential for full integration of the traditional roles of client, constructor and designer. In addition to integrating key NZTA staff within the alliance, the NZTA elected to introduce the function of an owner interface manager (OIM) who is accountable for delivery of the project elements and delegated to making project decisions on behalf of the client.

The OIM is supported by an owner verifier (OV) with relevant tunnelling and M&E experience to fill the skill gap in NZTA. The OV, staffed by experienced tunnel engineers familiar with construction of road tunnels, Auckland conditions and international best practice for risk management, is outside the alliance and provides independent technical advice on behalf of the NZTA, during both the project procurement and delivery phases.

Project development stage

One of the key requirements of TCoP during project development is the assessment of project options and this includes:

- Geology and hydrogeology

- Tunnelling methodologies

The tunnel is to be excavated predominantly through shallow dipping alternating beds of extremely weak to weak sandstone and siltstone. At the northern end the tunnel passes through mixed face conditions of sandstones overlain by firm to stiff clay of the Tauranga Group.

Extensive geotechnical investigations were carried out and the findings collated in a geotechnical data report for use by the tenderers. Tenderers were also invited to review the geotechnical information available and to request additional investigations that were carried out by the NZTA during the tender period. Extensive hydrogeological investigations and interpretation was undertaken prior to the commencement of the tender period, which identified an area of predicted high water ingress to be up to 60 litres/sec was identified. Modelling was undertaken to determine the extent of drawdown for various tunnelling methodologies and all this reporting was made available to tenderers.

Tunnelling methodologies

Project development included study of both a sequential excavation method (SEM) tunnelling operation in combination with cut-and-cover works, and an EPB TBM alternative, with both methods confirmed as viable. The tender documentation left the selection of the tunnelling methodology to the tenderer, with minimum requirements specified for each of the tunnelling methodologies including mandatory forward grouting for the SEM methodology and a detailed EPBM specification for the TBM option.

The greatest risk identified on the subsurface alighment was the low 9m cover to the arterial road and through a section of mixed face conditions with soft ground in the crown (Fig 2). The SEM solution proposed a 500m of cut-and-cover consturction to mitigate the risks, which imposed significant disruption associated with traffic and services diversions, and additional cost due to the physical works and the longer program. For the EPB option, the face stability risk in the shallow soft ground conditions would be mitigated with closed mode EPB operation.

Procurement of the construction contract is a key aspect of the risk reduction sought by TCoP and detailed measures were applied to reduce risk during this stage. The context to the increasing importance placed on risk management, was in reference to losses suffered by tunnel insurers over recent decades. The insurance industry had reported a general trend towards high-risk type construction methods, often delivered using design-build contracts with one-sided contract conditions, in an environment of fierce competition(3). There are many guidelines on risk management strategies(1) and some of the key points for the project, as they relate to the TCoP, include the recommendations:

- to include in the tender documents specific technical requirements such that risks are managed in accordance with the risk strategy, with explicit allocation of responsibilities for risks;

- tender evaluation procedures should include an evaluation of the contractor’s ability to identify and control risks by the choice and implementation of technical solutions; and

- systematic assessment of the differences in risk between the project proposals by different tenderers. Generally risk should be allocated to the party who has the best means for controlling them.

As part of its rigerous risk management, the NZTA placed high value on measures to address ground risks - as is appropriate for a major tunnel project - and developed an alliance geotechnical baseline report (AGBR) to provide a framework that deals with geotechnical risk within an alliance delivery vehicle and support the discussion and treatment of risk to achieve the goals of TCoP. Due to the specific nature of an alliance agreement, where all risks are shared equally between the NZTA and the non-owner participants, the function of the AGBR is different to a Gold Book GBR that seeks to allocate risks to one party or another.

Baselines of low probability but high consequence geotechnical risks that may otherwise impact the target outturn cost (contract price) and which may also have the potential to skew the competitive tender process would be defined by agreement, with the wording of the AGBR and the baselines agreed by the NZTA and the alliance proponents prior to submission of tenders. This developed a common understanding of the risks included within the tender and those excluded. The final AGBR document meets the requirements of ground reference conditions as defined by TCoP and the final agreed version of the excluded risks was incorporated into the project alliance agreement (PAA).

The intention was that the AGBR be used during the procurement process with use of baselines to define the range of expected behaviours or limits or boundaries only to be used to define extreme situations. It was acknowledged that the treatment of risk is fully and openly dealt with by adjustment of the TOC (target outturn cost). For this reason, any geotechnical risks that remained outside of the TOC were only accepted by the NZTA if they were considered extreme events. The test of an extreme event or condition described by the baseline must be visible and significant with severe and measurable impact on the progress of the works over a sustained period.

During the procurement and tendering process, a series of alignment workshops were a key part of managing the project’s risk profile. Each tenderer is looking for ways to achieve a competitive advantage, with the main goal of winning the project and this focus inevitably leads to some alternatives that may be cheaper, but have much higher risk.

The robust interactive AGBR development process followed during the development of tender proposals eliminated any construction methods that included unmanageable risks. A good example of this was the process that tenderers followed in comparing the SEM and EPBM alternatives. Tenderers identified that the cut-and-cover tunnel crossing of the major road was going to be disruptive and expensive and one of the tenderers considered replacing the cut-and-cover with SEM tunnelling under the road but NZTA considered this alternative included potentially unmanageable risks, and this was communicated via the series of AGBR alignment workshops.

As a result both tenderers based their tenders on EPBM methodology, which minimised overall project risk and provided a value for money solution, although a TBM of 14.46m diameter and one of the largest TBMs operating in the world at the time was required for the twin three-lane highway tunnels and presented identifiable risks in itself.

An example of an extreme event within the AGBR concerned the disruption associated with removing concretionary clasts. Known to exist within Auckland but not effectively quantifiable by a drilling programme, the strength of these clasts, which can be up to 120 MPa, was used to define the design of the TBM cutters, and their likelihood of being encountered was included as a baseline with more than 10 cutterhead interventions to deal with clasts determined in the AGBR as an extreme event.

Construction contract -rocurement process

In procurement of the construction contract, the NZTA used a three stage process over a 19 month period (Fig 3) with the seven month interactive tender process based on what the project team referred to as the four Ps - product, process, people and price - as it was recognised that to procure a proponent to deliver the project, we needed to ensure we were being offered, and could build, the right product through a robust process delivered by the right people for the right price. Key features of the interactive tender process included strict probity protocols to ensure that commercial-in-confidence information provided by one consortium was not divulged to the other.

In conducting a competitive procurement process, to achieve value for money but without elevation of project risk, the Waterview project adopted further measures including reimbursing the two tenderers a fixed sum equivalent to 60% of expected tendering costs. This was set at NZ$18 million and in exchange for the tender reimbursement, the NZTA owns the intellectual property generated by each of the consortia including all tender design material and risk mitigation methods. The benefits of owning the tender materials is that the project risk and cost can be reduced by incorporating good ideas from the rival tender. For Waterview, alternative designs for the ventilation fans and lighting from the rival tender were incorporated in the final alliance agreement, the savings being greater than the tender cost reimbursement to the losing tenderer.

Through the tender evaluation procedures, tenderers are incentivised to maximise value while retaining the ALARP principle with respect to design and construction works and impacts upon third parties, and this was achieved through an interactive tender process comprising a combination of alignment workshops and technical/consent meetings held separately with each proponent.

Eight weeks before tender close the tenderers were also required to submit their tender design drawings for compliance review against requirements and minimum standards, and to feedback on all identified non-conformances through a serview of alignment workshops. While there are some probity risks with this process, they are not significantly different to any interactive tender process and there are benefits for both the owner and the tenderer. Due to the two-envelope evaluation process adopted, where tangible cost adjustments are made to the tender price for non-conformances, tenderers are keen to ensure that their tender design conforms to the project requirements and will not attract a price penalty during the evaluation. For the owner this process ensures there will be no non-conforming tenders which make evaluation difficult. It also allows the risk profile of the tender design to be evaluated, and further alignment with the tenderers on the risk profile can be achieved prior to the final tender submission.

A benfitial innovation secured through the producement process was the use of a gantry, independent of TBM, for consequent placement of the precast culverts for the services conduit in the invert of each tunnel while allowing access of supply vehicles through the gantry for delivery of segments and other supplies to the TBM with about ten multi-service vehicles passing through the gantry each shift

The technical/consent meetings with proponents were framed to encourage innovation, but also included specific technical requirements to ensure risks are managed in accordance with the risk strategy. Tenderers were encouraged to challenge the minimum requirements through the submission of departures, supported by a risk and opportunity statement that ensured the departures did not result in the elevation of project risk. In addition to the departure process, these meetings also proved useful in ensuring that the emerging conceptual designs would be acceptable and reduced the risk of a tangible cost adjustment (TCA) being imposed.

Evaluation was undertaken in accordance with NZTA two-envelope procedures. Envelope one contained all non-price information including relevant experience (10%), relevant skills (30%), resources (20%) and methodology (40%) and associated information including construction methodology, risk register and operations and maintenance plan. The non-price attribute scores were converted to a supplier quality premium based on NZ$100 million per 10% difference in overall attribute grades for quality of service or how’things are delivered, while tangible cost adjustments were applied to quality of product differences or what is being delivered. Tangible cost adjustments were identified in one of three ways.

- Quality of product - whole of life costs, benefits and risks with respect to the quality of the product offered by one proponent, relative to that of the other proponent, including operation and maintenance regimes;

- Key result areas of the project alliance - risk associated with actual out-turn cost likely to result from the non-cost performance parameters offered by one Proponent, relative to that of the other Proponent, during the design and construction period; and

- Risk exceptions – perceived proposed changes to the risks transferred to NZTA under the AGBR and/or the variation benchmarking register, as well as residual risks, including those arising from construction methodologies, key plant resources proposed and mitigation strategies detailed in the risk register.

This evaluation method was described in detail in the request for tender document and the ability of the evaluation team to adjust the tendered price for evaluation purposes means the tenderers take the process seriously. It was a key mechanism in avoiding the elevation of project risk during a competitive tender process.

With both proponents finding the ‘sweet spot’ through the tender process, the result of the tender evaluation was a slight advantage to the Tuhono consortium, but this was negated by a lower tender price submitted by the Well-Connected consortium that became the preferred proponent on 18 August 2011. Of particular satisfaction to NZTA, was that both proponents had lower than expected allowances for risk and contingency. Feedback at the tender debrief sessions was that:

- The interactive tender process allowed proponents to fully understand the NZTA requirements;

- The extensive work done in preparing the conceptual design and the feedback received through the Certificate A process had minimised design uncertainty;

- The AGBR risk allocation and commercial principles negated risk associated with tunnelling uncertainty.

| Table 1. TBM progress statistics | |

| Best shift | 16m |

| Best day | 30m |

| Best week | 126m |

| Average week 1st drive (after learning curve) |

66m |

| Average week 2nd drive (after turn around) |

88m |

A result of the entire procurement process was the decision by the alliance to use one TBM to excavate the twin Waterview tunnels. TBM assembly started in August 2013 and the 31 October 2013 ready-to-bore date set by the alliance was met.

The first drive towards the northern portal started in November 2013. Initial performance was slower than expected dur to a longer-than-planned learning curve but performance picked up substantially to exceed planned rates (Table 1). To achieve breakthrough on programme at the end of September 2014. The TBM was then turned into the parallel drive, re-starting in mid-December 2014 achieving final breakthrough within 10 months in October 2015, including the three-month turnaround. Due diligence during the project planning and through the procurement process reaped the desired rewards.

Author References

- Eskesen, S D, Tenborg, P, Kampmann, J and Veicherts, T H, 2004. Guidelines for tunnelling risk management: International Tunnelling Association, Working Group No 2, in Proceedings Tunnelling and Underground Space Technology, pp 217-237 (International Tunnelling and Underground Space Association).

- International Tunnelling Insurance Group, 2006. Code of Practice for Risk Management of Tunnel Works (The International Tunnelling Insurance Group).

- Wannick, H P, 2006. The Code of Practice for Risk Management of Tunnel Works – Future tunnelling insurance from the insurers’ point of view, presented to ITA Conference Risk Management Open Session presentation (International Tunnelling and Underground Space Association).

References

- VIDEO: Waterview highway TBM tunnel final breakthrough – TunnelCast, October 2015

- Managing progress at Waterview – TunnelTalk, March 2015

- Tail seal issues fail to slow Auckland mega-TBM – TunnelTalk, October 2014

- Ramping up mega-TBM progress in Auckland – TunnelTalk, February 2014

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.