Alaskan Way mega-project procurement

Oct 2010

Shani Wallis, TunnelTalk

-

Bids to build the world's largest TBM bored tunnel are due in by 28 October 2010. As well as operating the world's largest TBM to date, the team selected to build the Alaskan Way bored tunnel replacement of the elevated highway in Seattle, Washington, will manage one of the most demanding of urban tunneling projects. TunnelTalk visited the management offices earlier in the year to understand the strategy for realizing this mega project under Seattle's downtown city center.

- When bids are returned at the end of the month, proposals will detail construction of a four-lane double-deck tunnel to replace Seattle's elevated SR-99 Alaskan Way State highway. Like all things about the Alaskan Way viaduct replacement project, the procurement process and contract documents have their own unique variations. Managing excavation of a minimum 54ft or 16.5m diameter TBM tunnel directly under the heart of the city in itself pushes at the boundaries of existing urban bored tunneling experience.

- Proposals are within budget

-

Both bids submitted on Thursday 28 October to design and build the SR 99 Alaskan Way replacement bored tunnel project in Seattle were at or below the contract price limit. Submittals are from two international teams of

Seattle Tunneling Group (STG) comprising S A Healy, which is owned by Impregilo of Italy, and FCC Construccion, SA of Spain with designers Parsons Transportation Group and Halcrow; and

Seattle Tunnel Partners (STP) of Dragados-USA, a subsidiary of the Spanish parent company, and designer HNTB Corporation. - Bids will now be evaluated by representatives from WSDOT, the Seattle Department of Transportation, industry experts and the viaduct-replacement program's Strategic Technical Advisory Team to ensure each complies with requirements. During evaluations a system of credits will be awarded for areas where the teams offer creative ideas and different ways to accomplish WSDOT's goals and minimize disruptions to the community during construction. These technical credits will be subtracted from the cost price of each bid when the financial part of each proposal is opened in December. This will identify the best value proposal.

- Total cost of the proposed bored tunnel is estimated to be $1.96 billion. This includes design, right of way, construction management, and more than $200 million set aside for risk. Also included in the $1.96 billion are separate, future construction contracts for roadway connections at the north and south ends of the tunnel. Major items in the design-build contract include the TBM bored tunnel, building the road within the tunnel with ventilation, fire/life safety and electrical systems, two operations buildings, tunnel settlement mitigation and portal construction. Bids include a mix of lump-sum, unit price and shared contingency amounts. Most of the work is to be included in the lump-sum, fixed-price bid item.

- The design-build contract for the tunnel is scheduled to be awarded before the end of January 2011 and target date for opening the new highway to traffic is 31 December 2015.

- At a press conference on Friday 29 October, Washington Transportation Secretary Paula Hammond said: "We have worked diligently with the design-build teams during the past eight months. I'm proud that the end result is two proposals that are within our project budget. After an in-depth review, we will award the contract to the team that has and has the best-value proposal."

- Governor Chris Gregoire said: "After 10 years of debate, 90 alternatives, and eight studies today we are returning the waterfront to the people of Seattle and keeping our economy moving. We can't afford to wait. Replacing the Alaskan Way Viaduct is a critical public safety project. The bored tunnel preserves capacity, is essential to our state's commerce, and keeps traffic moving through the entire construction process. We owe it to the families and businesses who will spur our economic recovery to complete this project. Today's bids meet our needs while being on budget and on time to protect the state's taxpayers."

- Plans for replacing the 65-year old highway across Seattle's foreshore started in 2001 when a heavy earthquake left the elevated structure severely damaged. At that time bored tunneling was rejected as being too technically demanding and too expensive compared with like-for-like viaduct replacement, at-grade schemes, or cut-and-cover subsurface alternatives.

- Six years later the situation had changed. Mega TBM tunnels of 14m and 15m diameter and more had been completed around the world in Spain, China, Japan, Germany, the Netherlands and Russia. Added to that techniques for geotechnical investigation and interpretation had improved; contractual mechanisms for sharing geotechnical risk, such as GBRs, had developed; and the technical capabilities of mitigating the risk of settlement damage to adjacent and surface structures had advanced.

- In a political coup that followed a period of project stalemate in 2006-20007, a powerful lobby of businessmen and advocates working with experienced and passionate tunneling engineers, convinced State, City and County politicians that not only was the mega bored tunnel environmentally and socially preferable, it was also technically and financially feasible. After a seven-week period of frantic activity over the 2007-2008 end of year holiday period, the Washington State Governor, with the Mayor of Seattle and the King County Chief Executive, announced in January 2009 that a giant bored tunnel was now the preferred option and the one to be taken forward for procurement.

- Since then one of the most comprehensive geological investigations of conditions under the city of Seattle has been carried out; preliminary engineering has progressed to release of documents for procurement of a design-build construction contract; price estimates have been calculated; construction groups have prequalified; funding mechanisms have been established; and principal suppliers of equipment, materials and services to a project of this size and complexity have been brought on side. All this work is set against a political scene that remains fractious.

- Anti-tunnel groups keep up their protest and elections in 2009 saw the largely pro-tunnel city council pass from the leadership of a mayor that put his job at stake in support of the tunnel, to one who campaigned against the tunnel proposal, its cost and its funding structure.

- Despite this, the Washington State Department of Transportation (WSDOT) as the public owner of the elevated highway SR-99, and principle stakeholder of the replacement project, has continued the procurement process, recognizing that staying on schedule and meeting procurement milestones are the most important criteria for keeping the project viable and on track.

- During a trip to Seattle earlier in the year, TunnelTalk met with Ron Paananen, the project's Program Administrator for WSDOT; Linea Laird, the Project Manager; Christopher Bambridge, Tunnel Engineering Manager with Hatch Mott MacDonald, the project's Program Management and Advisory Consultant (PMAC); and two of the project's most dedicated tunnel engineering supporters, Harvey Parker of Seattle and John Reilly of Boston. TunnelTalk also attended a meeting of the influential lobby group that helped bring about the bored tunnel solution.

-

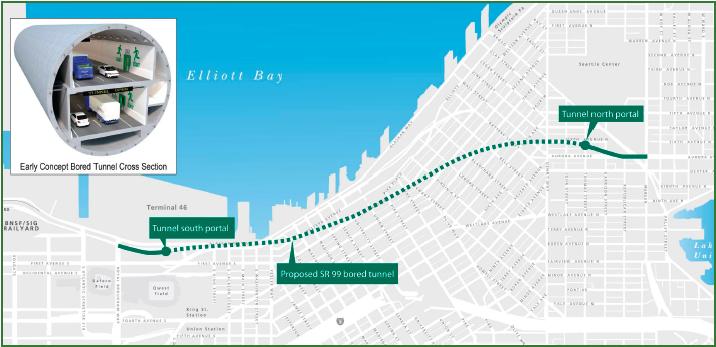

Proposed bored tunnel replacement of the earthquake-damaged viaduct

-

Tunnel dimensions, route and risks

The 9,100ft (2.7km) long, four-lane, double-deck tunnel is the centerpiece of a project that will change the way Seattle works. From an open cut transition portal at the south end, close to the foreshore, Traffic will enter the tunnel and run initially beneath the viaduct before branching north to follow First Avenue and pass on under Seattle's steeply rising topography to rejoin the existing highway at the cut-and-cover north portal transition structure. The 54ft (16.5m) diameter TBM will operate at between 60ft to 200ft (18-60m) beneath the streets of the city and work through Seattle's complex geology of mixed glacial deposits of sand, gravel, tills and clays, and un-graded landfill materials, all of which host a high ground water table. - Specifications within the bid documents are minimal. Much of the means, methods and risk mitigation measures are left to the expertise and preferences of the prequalified design-build bidding teams. As Project Director Paananen explained: "Design-build is by far the fastest method of realising the project. This is vital given the urgent need to replace the quake-damaged viaduct. It also allows the bidding team to incorporate innovations to maximize value engineering cost savings and manage the risks to its best experience and expertise."

- The specification in the contract documents is for a single TBM-bored tunnel to provide four lanes on a double deck carriageway with two 11ft-wide traffic lanes, a 6ft shoulder lane and a 2ft walkway on each deck and with a height clearance of 15ft above the main traffic lanes to accommodate all types of traffic including sixteen-wheeler freight trucks. That makes for a minimum 54ft or about 16.5m tunnel diameter excavated by the largest TBM manufactured to date.

-

Viaduct cuts across Seattle's central waterfront

- Options for two smaller diameter bores, it was explained, will not be entertained. "The scheme approved by the public owners is for a single-tube, four-lane, TBM-driven tunnel," said project advisor and advocate Harvey Parker. "Changing that configuration would cause unacceptable delay to the procurement process."

- Christopher Bambridge of the client's PMAC (Program Management and Advisory Consultant) team added that the twin tube option had been studied but had proven less cost effective than a single large diameter bore.

- "Two tunnels for two main traffic lanes in each would be about 40ft (12-13m) diameter in any case, which would be more expensive in nearly all regards. Two 40ft TBMs would be more expensive than one 54ft machine; two tunnels would excavate more material and more require more lining installed; two machines would required twice the crew numbers; escape cross passages or a third service tunnel would be needed for the twin bore concept; and the settlement corridor above a twin side-by-side tunnel option would be wider and potentially more damaging."

- For these reasons, and more, the single large diameter tunnel is specified. All the planning, environmental impact statements and risk assessments have been concluded for a single bored tunnel.

- For most of the drive, the watertable is at ground level and constant. With up to 200ft of cover over the drive the maximum hydrostatic pressure at TBM invert is 5 bar, with a potential 1.5 bar pressure difference across the face of the giant TBM from crown to invert.

- A closed face pressurized TBM operation is specified with the bidders making the decision between slurry or EPB technology. In addition to the type of machine and its exact diameter, the design of the segmental lining (above a specified minimum thickness), and the disposal of tunnel muck, among so much else, is for the contractor and his contract engineer to propose and manage.

- Monitoring and mitigation of settlement is also to be managed by the design-build contractor within a fixed schedule of shared liability with the client. The project envisages a vast real-time instrumentation data collection and management system that the contractor will design and implement with the readings being distributed to all stakeholders and reviewed at daily management meetings.

- Where possible the tunnel runs under public property, passing just beneath the piles that support the elevated viaduct and under city streets for the most part, except where deviations take the drive close to or under the footprint of private buildings, the tallest being the multi-storey Stock Exchange highrise.

- Buildings and structures are classed into different categories and the client defines allowable settlement limits for each. For the most sensitive structures the client will share the risk of settlement control dipping into a $40 million pool of funds extra mitigation measures over and above those proposed by the contract.

|

|

|

-

Contract payments and construction program

When bids are returned on 28 October, they will comprise two parts – a technical proposal that will be opened for evaluation during the coming months and a financial proposal that will opened on 23 December. It will be a combination of both parts, plus the calculation of technical credits earned through the technical appraisal, that will determine the preferred bidder. In a novel evaluation process, innovative solutions in the bids will be given a value according to the financial benefit to the client and this will be deducted from the financial proposals when they are opened on 23 December. The system of credits will influence the price and identify the lowest. Bids will be based about 85% on fixed lump sum costs and about 15% as unit price schedules.

- Particular credits will be earned for finishing the project earlier than the official opening date of 1 November 2016. For each day saved towards the targeted opening date of 31 December 2015, the design-build contractor will earn a technical credit of $50,000/day, which will be deducted from the cost proposal. Liquidated damages of $50,000/day will be imposed for every day passed the contractor's set completion date with the penalty rising to $100,000/day for every day late beyond the official end date of 1 November 2016.

- The overall estimate for replacement of the Alaskan Way viaduct is up to $3.1 billion. Within this, the bored tunnel part of the complex undertaking that includes removal of the old elevated viaduct and complex access projects at the tunnel portals, is estimated at up to $2.1 billion with a 60% probability that it will cost $1.96 billion or less according to the Cost Estimate Valuation Process (CEVP) used to estimate a budget for the project. Within this, the design-build contract for the TBM bored tunnel is expected to be about $1.2 billion. The $1.96 billion estimate for the tunnel includes design, right of way, construction management, and $415 million set aside for risk mitigation, contingency and inflation.

- Funding for the wider $4.24 billion project that includes replacing the earthquake damaged seawall as well as replacing the elevated viaduct, is divided between the principal stakeholders and beneficiaries. As owner of the highway, the State has pledge a maximum $2.8 billion while the City of Seattle has allocated $927 million, the County that runs public transit bus services on the highway is contributing $190 million and the Port of Seattle, which will benefit by the easier accesses to its facilities offered by the new highway configuration, has pledged $300 million to the project.

-

Closure of the viaduct for several months for earthquake damage repair caused gridlock on the city streets

- In a particular complication that has funding of the project in a precarious balance, however, the language of the legislation that approves construction of the project, leaves the City of Seattle, as the principal beneficiary of the project, responsible for any potential cost overruns. This exposes the City to considerable financial risk and in another political twist, the City Council has postponed committing to the project until January 2011, until after the proposals from the contractors are in, the financial parts of the proposals are opened in December 2010, and a more confirmed estimate of the cost is presented by the construction teams vying to build the job.

- When due on 28 October, two proposals are expected. Of the four prequalified groups, the two that have confirmed they will submit a proposal are:

-

Seattle Tunneling Group (STG) comprising S A Healy (100% owned by Impregilo of Italy) and FCC Construccion, SA of Spain with designers Parsons Transportation Group and Halcrow; and

Seattle Tunnel Partners (STP) comprising Dragados-USA, a subsidiary of the Spanish parent company, and designer HNTB Corporation. - Of the other two prequalified groups, the Vinci/Traylor/Skanska JV with Arup officially withdrew from the process earlier this year and the AWV Joint Venture of Kiewit Pacific and Bilfinger Berger with designer AECOM has stated verbally that it will not be presenting a bid.

- Within the TBM manufacturing industry Herrenknecht has declared that it is keen to win the machine supply contract. At a reception at the NAT conference in Portland in June this year, company founder and Director, Martin Herrenknecht, stated clearly that he relishes the opportunity to price the TBM contract and the chance to build the world's largest TBM to date. The Robbins Company, with its and global home base so close to Seattle in Kent, Washington, is also known to be working in collaboration with French soft-ground TBM manufacturer NFM to bid the design and supply of the machine. Lovat has stated that it will not be bidding the project, and others are yet to declare their position.

-

Moving forward

When bids are returned and the financial proposals are calculated, an award of contract is schedule before the end of January 2011, before the start of the new legislative sessions after the holidays. This will undermine any attempts by anti-tunnel lobbyists to turn back legislation that approves commitment to the bored tunnel replacement of the viaduct. - However there is one further legislative hurdle to negotiate.

- Approval of the bored tunnel project is subject to the outcome of the final Federal environmental impact statement (EIS) that is expected in August next year. When an award of contract is announced in January, the design-build group will be given the first notice to proceed with work that is 'project neutral'. The supplemental EIS for the bored tunnel is expected to be approved but other options are included in the evaluation process, including rebuild or refurbishment of the existing elevated structure and the earlier cut-and-cover options.

- Advancing the bidding process months ahead of that provides a year's head start on the project. A substantial amount of design work is required ahead of building the tunnel. A second notice to proceed will be issues once the final EIS and ROD (Record of Decision) is secured. If, for any reason, the project fails to secure the EIS ROD, the contract details the process of canceling the contract.

- As it is for the moment, and set against a determination of the Mayor to overturn the City's exposure to any risk of cost overruns, bidders continue to finalize their proposals.

- Given the history of tunneling in Seattle - as home of some of the earliest shield-driven sewer tunnels in the United States; as home still of the world's largest soft-ground highway tunnel, the 63ft (19m) diameter multi-drift pre-supported Mount Baker Ridge Tunnel; as home of the deepest SEM/NATM/SCL metro station structure on the Sound Transit system at Beacon Hill; as home of the oldest double track railway tunnel in the United States that was opened in 1904, built largely by soft-ground hand mining methods on multi-drifts, and passing under the city to King Street Station; and which honors its connection as home of the renowned Robbins TBM manufacturing company – this city has precedent for taking on this project and succeed once again against some formidable odds. There are so many more chapters of this remarkable project story to tell.

-

Proposals called for Seattle's big bore tunnel - TunnelTalk, May 2010

Taking mega TBMs to greater limits - TunnelTalk, June 2010

Alaskan Way pre-qualifiers and cost review - TunnelTalk, January 2010

Alaskan Way frustration - TunnelTalk September 2007

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.