A prospective for 2021 and beyond 07 Jan 2021

2021 has arrived and it is much like a seamless continuation of last year with end of year celebrations much subdued and the battle to defeat the coronavirus infection and spread remaining with us. We all plan for a better-managed year ahead and looking beyond Covid-19, while being tempered by its impact, there are horizons attracting attention and creating a perspective that provides for brighter objectives and opportunities to keep us going.

A consequence of the coronavirus pandemic impact is exposure of the equally urgent need to address the causes of global climate change and the need to dramatically reduce carbon emissions into the atmosphere. The dramatic and sudden reduction in aeroplane and road traffic focused attention on the need to improve air quality in all major conurbations of the world. This presents major opportunities in the transportation industry as does management of flooding and drainage issues caused by extreme weather events and the need to increase the percentage of global energy generation by non-carbon emission sources including hydro and nuclear power. All three industries – transportation, water management and power generation – provide particular opportunities for a shift in the pre-Covid business focuses to those of a new start future.

Transportation

An unfortunate consequence of the pandemic has been an increase in private car commutes as travellers shy away from mass transit metro and train options. On the other hand, the move to greater work-from-home routines and the need to address climate change issues will continue to focus on alternatives to air and land transportation systems. Once the pandemic is under control, more metro systems and high speed intercity and national connections in addition and as an alternative to air travel will become a focus.

Hyperloop for high speed land connections for both passengers and freight transportation presents an exciting vision as does the development of floating tunnels across deep water barriers. Of the different hyperloop projects being developed, Virgin Hyperloop is making most headway, conducting its first human passenger test of the system at its full-scale test facility in Nevada, USA. Four passengers travelled at 173km/hr along the 500m above-ground test tube with the pod propelled by electric magnetic levitation, with the tube pressurised to near-vacuum environment or under 100Pa or equivalent to the air pressure at 200,000ft - 61,000m above ground level. More news about hyperloop developments will be the TunnelTalk Focus during January. Metro and high-speed rail expansion also remains a focus for capital investment in the coming decade with many projects progressing and others in advanced planning and feasibility stages.

Hydropower Focus articles

Energy generation

The shift to carbon emission limiting electric power generation is an ongoing process around the world with extensive underground infrastructure needed for both. Long water conveyance networks and immense underground caverns are created for the operation of hydropower stations. There is still substantial hydro power potential in the world yet to be exploited. The TunnelTalk Focus of March 2020 explored the development within the hydro industry.

Cooling water systems are a central element of nuclear power plants and similar sized caverns could be excavated for the safer location of nuclear power plants underground. In tandem with nuclear power plants is the continuing urgent need for underground repositories for the safe long term and secure storage of the radioactive waste generated by the operation, maintenance and decommissioning of nuclear power stations. The vision development of underground nuclear power plants could include creation of an underground facility of secure storage of the associated waste in the same location and as part of the same construction project. The TunnelTalk 2020 Focus articles in June and July 2020 presented the current state of nuclear waste management in different nuclear power generating plants around the world.

Water supply and drainage

Many have long predicted that management of the fresh water resources on the planet will be a global political and humanitarian urgency for the future, not only for the under privileged of the world but for those who would use a disproportionate amount of the resource and for the vital food producing industries. As well as supply and distribution of potable water, the need is to manage fresh wastewater and stormwater. All nations of the world are progressing both supply and wastewater management projects with a shift in underground infrastructure focus bringing greater emphasis to these needs globally.

Nuclear Waste Management Focus

- Global dilemma of nuclear waste management

- Rock mechanics and nuclear waste disposal

- Activities for nuclear waste disposal development

- Public debate to progress nuclear waste options

- USA nuclear waste options undermined by politics

- Disposal programme for UK radioactive waste

- Excavation and operation of Hungary repository

- Russia to improve nuclear waste management

Technological advance

For the industry as a whole, the future must also include technological advance of the underground excavation processes to reduce the costs involved, increase the speed of advance and reduce the industry's carbon footprint. The work has already begun and there are leading examples of how robotics and artificial intelligence is providing significant developments and improvements in excavation performance, safety and by association the costs of underground construction.

There are also many research and development projects underway to improve lining systems to reduce the carbon footprint and speed excavation progress while others have and are concentrating on the more efficient and environmentally conscious methods of recycling and disposing of excavated materials.

A significant development is the conversion of diesel operated equipment in the industry to battery powered alternatives. Unlike the introduction of battery powered cars and road vehicles, the scale of providing battery alternatives for construction equipment has been a barrier. To address this issue, a company in Ireland has developed an off-the-shelf platform approach to battery systems with the batteries needed for different types of construction equipment being built by adding standard components or cells. By standardising on the 2170 cylindrical lithium nickel manganese cobalt oxide (NMC) or lithium nickel cobalt aluminium oxide (NCA) technology battery cell, rather than the traditional lithium iron phosphate (LFP) technology, Xerotech can hold cells in stock and manufacture various pack sizes and types depending on the project requirements.

Together with technological advance, the industry is concentrating also on new forms of contract that are modelled specifically for the underground construction, and the risks associated, to improve the procurement and delivery of underground infrastructure. A recent development is the introduction of the joint FIDIC-ITA Emerald Book form of contract developed specifically for underground construction projects.

Of projects in construction in 2019, an estimated €360 billion is required to complete them over the coming three years

Global market survey

As the long-established organization representing the industry the globally, the ITA International Tunnelling and Underground Space Association has maintained and updated an industry market survey since the first edition in 2014. While it admits that acquiring global data is difficult, it has harnessed the input from its 78 Member Nations and has released its survey of 2019 that analysis data from 96 countries and based on collecting more than 80%-90% of what has been logged in term of tunnelling works during the year. The data represents more than 4,200 underground construction projects of all types and values from mega construction projects to the smallest in scale, 1,615 of which were in construction in 2019 and another 2,615 in study or planning.

As a headline, the survey reports that the global output for tunnels and underground space construction in 2019 was €125 billion. This is up from €86 billion in 2016 to represent a growth of between 7% and 9% per annum and to maintain an average output in terms of kilometres of 5,200km per annum. While global growth did slow in 2020, due to lower productivity and the delayed start of projects as a consequence of the coronavirus pandemic, with overall global construction expectations for 2021 at $10.1 trillion, the ITA survey predicts an investment in underground projects over the next 11 years of €1,385 billion.

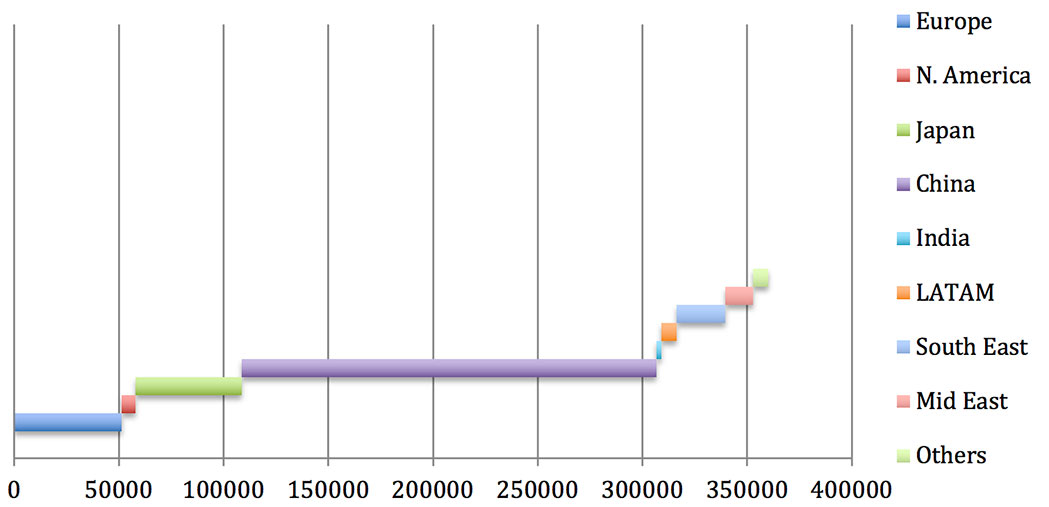

China, as by far the most active and largest nation in the underground construction industry, dominates and influences the survey data. Altogether it represents more than 2,000 projects in the 2019 survey with 750 in construction 1,280 in planning. Of the estimated €1,385 billion of tunnelling works over the coming 11 years, €472 billion is in China. For the projects in construction in 2019, the output to be invested to complete these projects during the coming three years is estimated at €360 billion, including €200 billion for projects in China (Fig 1).

A review of the data indicates that of the €125 billion underground construction output of and 5,200km excavated in 2019, rail accounted for 29% of the length and 34% of the output. road for 29% in kilometres and 40% in output, metro for 9% in kilometres but 16% in output, and those representing hydro and utility projects 33% in length and 10% in cost (Fig 2). In terms of usage, Japan provided the most detailed breakdown of its investment in underground construction over time both in capital expenditure and usage (Fig 3).

In terms of percentage of GDP (gross domestic product) underground construction worldwide represents an estimated 1.7‰, varying from 0.1‰ in North America to 3.9‰ in Asia and 3.5‰ in China (Fig 4).

While 2021 will continue to be dominated and influences by the global pandemic and its consequences, the future beyond is a new slate on which the reality of how we develop the fabric of society will be mapped, the underground being at the forefront of the construction possibilities and requirements.

References

- A grim 2020 that will not be forgotten – TunnelTalk, December 2020

- Underground excavation wish list – TunnelTalk, January 2020

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.