Looking back on 2019 26 Dec 2019

In the end of year report for 2018, the news was about several court actions and their verdicts. First was a significant win by local traders and residents against the disruption and loss of business caused by the open cut construction of the Canada Line LRT project in Vancouver in Canada. The action went against the client and its attempt to save money by rejecting the bored tunnel method in favour of cut-and-cover for a 7km long section of the 19km alignment.

At the end of 2019, it is another court action that is dominating headlines, this time in the verdict of a two-month jury trial that found against the contractor and in favour of the client in the case of Seattle Tunnel Partners (STP) versus Washington State Department of Transportation (WSDOT) for the costs of recovery and repair of the mega 17.4m diameter EPBM and the resulting two year delay on the construction programme of the SR99 highway viaduct replacement tunnel in Seattle. As well as rejecting its claim for $330 million, the ruling charged STP to pay the full $57.2 million in damages claimed by WSDOT in its counterclaim.

The ruling was a hard blow for the contracting consortium, which has lodged an appeal, and drew sympathy from readers and professionals in the international tunnelling industry. Readers remark in their comments that the jury verdict contradicts the findings of the Disputes Review Board (DRB) and neglects to take into consideration that the contractor honoured it commitments under the design-build contract to cover the costs of the TBM recovery and repair in the first instance, worked to mitigate the breakdown delays by advancing other works where possible, including starting construction of the upper road deck and keeping it concurrent with advance of the repaired TBM once it resumed the drive; and completed the TBM drive without further incident and towards an opening of the of the new underground highway to traffic in February 2019.

In another court case in 2018, an appeal court overturned the original finding for the contractor in the case of the Glendoe hydro scheme TBM drive headrace collapse in Scotland, UK. The Hochtief-led design-build contractor had previously defended itself successfully against the claim by the client to recover repair costs associated with the collapse in 2009. On appeal, the power company Scottish and Southern Electricity (SSE) won its case in favour of allowing its claim for £107.6 million of recovery repair costs and £1 million for business losses. In its 2019 year end results, SSE noted that it had reached an out of court settlement with Hochtief in respect of its claim for damages to bring the case to a close.

Legal case references

Formal legal objections were also lodged in Germany in mid-2019 against the approved construction of the 17.6km long Fehmarn road and rail sea link across the Femern Belt between Denmark and Germany. Seven complaints against the planned world-beating immersed tube tunnel were made during an official four-week period and Femern A/S, the project delivery company and client organisation, anticipates that legal challenges might take up to two years to resolve.

In the UK, the Government ordered an independent review of the high-speed rail project HS2 to decide whether, and how, to proceed. The review will examine the cost projections for Phase 1 of the project between London and the West Midlands, which is now estimated significantly more than originally expected at up to £86 billion. Critically, the review has been asked to consider the direct costs of cancelling or de-scoping the project.

Technology references

Modern technology in application

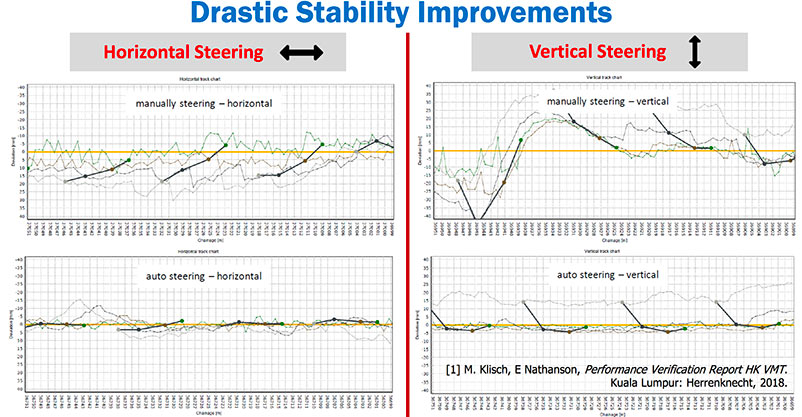

A major theme through 2019 has been the advancement of technology, particularly in the field of artificial intelligence and machine learning for autonomous TBM operations. Development and application of an autonomous TBM operating system by a team of engineers engaged by MMC-Gamuda on the Line 2 project of the Klang Valley MRT in Kuala Lumpur, Malasyia, was recognised as the winner in the new technology and innovations categories of the ITA Awards and of the UK Tunnelling Awards. The technology is based on custom artificial intelligence control algorithms analysing machine data in real time and assuming control of the various operational subsystems of the TBM with minimal human input.

In presentations about the technology, engineers stated that it is the proven success of TBMs under autonomous operation this is preferred and required when operating under the most sensitive of conditions, when the risks of human error or erratic machine operation would cause the most damaging of potential consequences. That is when one needs the machine to manage by itself to react and respond quickly and as required, explained the development team.

Several commentators have argued the wider legal and liability implications of a system that moves responsibility from a human operator to a machine system and others have commented that artificial intelligence depends on the experience and knowledge of the initial programmers, which could be questionable.

Obituaries

During 2019, the industry paid its respects to several leading professionals who died in 2019. None was more poignant than the death of Enrique González of Spanish contractor Dragados at the scene after being knocked down in cycling collision with a truck. González was the Dragados representative on many international tunnelling projects by the company including:

- Richard (Dick) Robbins 1933 – 2019

- James Monsees Died 5 August 2019

- Enrique F González 1958 – March 2019

- Giovanni Barla 1940 – 2019

- Fred Benjamin Estep 1938 – 2019

- James Barbera 1940 – 2019

- Vladimir Ratkowsky 1930 – 2019

- David R Yankovich 1953 – 2019

- Jack Feller 1922 – 2019

- Other accolades and tributes

- The Eastern Section of the Eglinton Crosstown Metro project in Toronto

- The Confederation Line for the Ottawa Subway

- The Hampton Roads highway bridge/tunnel crossing in the USA

- The Thimble Shoals project under Chesapeake Bay

- The effluent conveyance tunnel in Los Angeles

- The East Side Access railway project in New York City

- The SR99 double deck highway tunnel under the streets of Seattle

- As preferred bidder for construction of the £1.3 billion Euston Station terminus for the HS2 project in London in the UK

- A large running tunnel contract for the Crossrail project in London

- The WestConnex M5 underground highway in Sydney, Australia

- The Sydney Metro North West rail link in Australia

Others who died in 2019 include industry leaders Dick Robbins and James Monsees who was more many years head of tunnelling with Parsons Brinckerhoff in New York City, now WSP.

Company news and marketplace developments

During the year there were several buyouts and company news reports. Most high profile was the takeover of TBM manufacturer NFM by the German company Mühlhäuser. This however proved to be a troubled acquisition and by year’s end, the Mühlhäuser Group had declared bankruptcy and was itself looking for buyers for its different assets.

Company news references

- Mühlhäuser takes over NFM

- SMT Scharf hovers over Mühlhäuser assets

- Bekaert buys out Maccaferri

- China assists Moscow Metro expansion

- Chinese onboard for TBM-bored Helsinki-Tallinn link

- Paris Metro contract for Salini Impregilo

- Success for China-Canada partnership

- Address by Pietro Salini, CEO of Salini Impreglio

Interesting news from China was its continuing inroads into the international market place with Chinese contractors taking on projects in different countries of the world and Chinese TBM manufacturers being successful selling machines to foreign contractors for projects in Europe. Significant among these is the Chinese interest in construction contracts for the Moscow Metro in Russia and it interest in supporting a TBM-bored concept for the proposed Helsinki-Tallinn undersea railway link between Finland and Estonia.

Chinese TBM orders in Europe include the CREG machine ordered by Salini Impregilo for its contracts on Line 14 and Line 16 of the Grand Paris Express project and by the Vinci/Hochtief JV for excavation of 4.4km Sydhavn Metro Line 4 in Copenhagen, Denmark. There are also Chinese TBMs working in Turkey and in North America, Lovsuns, based in Canada and part of LNSS of China, has sold TBMs to the Blacksnake Creek stormwater project in St Joseph, Missouri; to the Westerley storage tunnel in Cleveland, Ohio; and to the Don River and Central Waterfront Coxwell Bypass tunnel in Toronto, Canada.

Speaking as the CEO of international contractor Salini Impregilo, Petro Salini gave an engaging overview of the health of the international tunnel and underground space excavation industry stating that continuing attempts by owners to shift risk onto the contractors who are bidding with ever decreasing margins will lead to “extinction” of contractors.

Conferences and events

A new era began for the International Tunnelling and Underground Space Association at the WTC2019 congress and general assembly in Naples, Italy, when the first woman, and a candidate from China for the first time, was elected as President of the Association. Jenny Jinxiu Yan took over the Presidency at a time when there is call from Member Nations for greater scrutiny of the Association Executive Council and its Secretariat and of its operations and finances. The work of an external audit as a one-off investment in its strategy for the future will continue ahead of the next ITA General Assembly to be held with WTC2020 in Kuala Lumpur, Malaysia.

It was a busy year for attending conferences and events starting with the bauma Munich construction equipment exhibition in Germany in April. WTC2019 in Italy in May was then followed closely by the RETC conference and exhibition in Chicago, USA in June. During the second half of 2019, TunnelTalk also attended the Salzburg Colloquium in Austria in October; the TBM DiGs event in Denver, USA and the ITA Awards and Cutting Edge conference in Miami, USA in November; and the STUVA conference in Frankfurt, Germany also in November.

Together with the WTC congress in Kuala Lumpur in May next year (2020) there will also be the NAT conference in Nashville, USA, in June and the AFTES conference in Paris in September.

Tunnel excavation wish list

Looking into the future, the BTS posed an interesting question recently: if we could increase productivity and reduce the cost of excavating underground space and tunnels significantly, and if tunnel length was not an issue, where would it be sensible to build underground facilities and tunnels?

A list of few is presented to provide inspiration (Table 1) and to add to the list include power cable and other utility conduits, waste water, potable water, and according to your own experiences and expertise and we will update the list as suggestions come in.

| Table 1. Start of an underground and tunnel excavation wish list | |||||

| Country | Tunnel | Length | Purpose | ||

| Spain to North Africa | Gibralta crossing | 60km | Rail | ||

| Eire to UK | Dublin to Anglesea | 100km | Road | ||

| China-India | Link under the Himalayas | Several of 20km and more | Rail | ||

| Norway | Ship tunnel | 1km | Canal | ||

| Norway fjord crossings | Floating tunnels to cross deep fjords | 5km and more | Road | ||

| Canada | Vancouver to Victoria Island | ||||

| England to Northern Ireland | Blackpool to Isle of Man to Belfast | 100 + 60km | Road/rail | ||

| USA - Russia | Across the Baring Straits | 90km | Rail | ||

| UK | Gosport to Isle of Wight | 6km | Road | ||

| UK | M25 Jn5 to M1 motorways directly under London | 60km | Road | ||

Visit the extensive and comprehensive Archive of TunnelTalk editorial content to know what else has kept the international tunnelling and underground space infrastructure industry busy and advancing during 2019.

References

- Project reaction and disruptions as 2018 phenomena – TunnelTalk, December 2019

- Crossing the Himalayas by rail – TunnelTalk, May 2012

- Chinese onboard for TBM-bored Helsinki-Tallinn link – TunnelTalk, August 2019

- Norway trims ship tunnel cost – TunnelTalk, November 2019

- Links across the waters – TunnelTalk, January 2010

|

|

|

|

|

Add your comment

- Thank you for taking the time to share your thoughts and comments. You share in the wider tunnelling community, so please keep your comments smart and civil. Don't attack other readers personally, and keep your language professional.